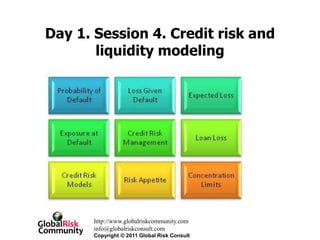

More Related Content Similar to LiquidityRiskManagementDay1Ses4.ppt Similar to LiquidityRiskManagementDay1Ses4.ppt (20) 1. Day 1. Session 4. Credit risk and

liquidity modeling

http://www.globalriskcommunity.com

info@globalriskconsult.com

Copyright © 2011 Global Risk Consult

2. Modelling methodologies:

(source:causal capital)

• The individual assessments of rating

agencies should:

1. Include the definition of default

2. Include the time horizon and the

meaning of each rating

3. Include the actual default rates

experienced in each assessment category

4. Include the transitions of the

assessments such as the likelihood of ‘AA’

rating becoming an ‘A’ overtime

http://www.globalriskcommunity.com

info@globalriskconsult.com

Copyright © 2011 Global Risk Consult

3. Conceptual Approaches to Credit

Risk Modeling

http://www.globalriskcommunity.com

info@globalriskconsult.com

Copyright © 2011 Global Risk Consult

• Over the last decade, a number of the world's major banks have developed sophisticated

systems to quantify and aggregate credit risk across geographical and product lines.

• The initial interest in credit risk models stemmed from the desire to develop more

rigorous quantitative estimates of the amount of economic capital needed to support a

bank's risk-taking activities.

• From a regulatory perspective, the flexibility of models in responding to changes in the

economic environment and innovations in financial products may reduce the incentive

for banks to engage in regulatory capital arbitrage.

• Furthermore, a models-based approach may also bring capital requirements into closer

alignment with the perceived riskiness of underlying assets, and may produce estimates

of credit risk that better reflect the composition of each bank's portfolio.

5. Applications of credit risk models

http://www.globalriskcommunity.com

info@globalriskconsult.com

Copyright © 2011 Global Risk Consult

• Credit risk modelling methodologies allow a tailored and flexible approach to price measurement and

risk management.

• The internal applications of model output span a wide range, from the simple to the complex. Current

applications include:

– Setting of concentration and exposure limits;

– Setting of hold targets on syndicated loans;

– Risk-based pricing;

• Improving the risk/return profiles of the portfolio;

• Evaluation of risk-adjusted performance of business lines or managers using risk-adjusted return on

capital ("RAROC");

• Economic capital allocation; and

• Estimation for setting or loan loss reserves, either for direct calculations or for validation purposes.

6. Some characteristics of an ideal

model for measuring credit risk

http://www.globalriskcommunity.com

info@globalriskconsult.com

Copyright © 2011 Global Risk Consult

• Ability to consider credit risk on a portfolio basis, taking account of default

correlation between each counterparty.

• Ability to take account of market movements and potential implications for credit

risk. This would be relevant for assets where the value depends on market

movements e.g. derivatives.

• Ability to consider mark-to-market values. That is, to allow for possibility of

upgrades and downgrades, not just default. Note that lack of data may make

this impractical.

• Ability to take account of varying recovery rates which would depend on the

seniority of the claim, the security held, and the legal system.

8. Measuring credit losses

http://www.globalriskcommunity.com

info@globalriskconsult.com

Copyright © 2011 Global Risk Consult

• Credit losses can be calculated as the sum of expected loss and unexpected loss

in a portfolio of assets.

• It can also be viewed as the difference between the portfolio's current value and

future value at the end of a time horizon.

• There are two fundamental approaches of evaluating credit losses at portfolio

level:

• Default mode (DM)

• Mark-to-market (MTM) paradigm

9. Default mode paradigm

http://www.globalriskcommunity.com

info@globalriskconsult.com

Copyright © 2011 Global Risk Consult

• Within the DM paradigm, a credit loss arises only if a borrower defaults within the planning

horizon.

• Consider a standard term loan. In the absence of a default event, no credit loss would be

incurred.

• In the event that a borrower defaults, the credit loss would reflect the difference between

the bank's credit exposure and the present value of future net recoveries.

• For a term loan, the current value would typically be measured as the bank's credit

exposure (e.g., book value). The (uncertain) future value of the loan, however, would

depend on whether or not the borrower defaults during the planning horizon.

• If the borrower does not default, the loan's future value would normally be measured as the

bank's credit exposure at the end of the planning horizon, adjusted so as to add back any

principal payments made over the period.

• On the other hand, if the borrower were to default, the loan's future value (per dollar of

current value at the beginning of the horizon) would be measured as one minus its loss rate

given default (LGD). The lower the LGD, the higher the recovery rate following default

10. Market to market paradigm

http://www.globalriskcommunity.com

info@globalriskconsult.com

Copyright © 2011 Global Risk Consult

• The mark-to-market (MTM) paradigm recognizes any gains or losses in

the value of a debt security caused by changes in the credit quality of

the obligor over the measured time horizon.

• If the credit quality of the obligors in a portfolio deteriorates as a result

of recession, the portfolio value will be lower, even without any

defaults. A market price for each debt security is obtained by

discounting cash flows on the obligor's credit curve.

• Most MTM-type credit models employ either of the following

approaches for the purpose of modeling the current and future (mark-

to-market) values of credit instruments.

– Discounted contractual cash flow (DCCF) approach

– Risk-neutral valuation (RNV) approach

11. Types of models

http://www.globalriskcommunity.com

info@globalriskconsult.com

Copyright © 2011 Global Risk Consult

• Unconditional models are those models that reflect relatively limited

borrower or facility- specific information.

• Conditional models are those that also attempt to incorporate

information on the state of the economy, such as levels and trends in

domestic and international employment, inflation, stock prices and

interest rates and even indicators of the financial health of particular

sectors.

12. Examples of unconditional models

http://www.globalriskcommunity.com

info@globalriskconsult.com

Copyright © 2011 Global Risk Consult

• Examples of unconditional credit risk models are the Unexpected loss approach,

CreditMetricsTM and CreditRisk+TM.

• All three modeling frameworks base expected default frequency (EDFs) and derived

correlation effects on relationships between historical defaults and borrower-specific

information such as internal risk ratings.

• The data is estimated (ideally) over many credit cycles. Whatever the point in the credit

cycle, these approaches will predict similar values for the standard deviation of losses

arising from a portfolio of obligors having similar internal risk ratings.

• Such models are currently not designed to capture business cycle effects, such as the

tendency for internal ratings to improve (deteriorate) during cyclical upturns (downturns).

13. Examples of conditional models

http://www.globalriskcommunity.com

info@globalriskconsult.com

Copyright © 2011 Global Risk Consult

• An example of a conditional credit risk model is McKinsey's CreditPortfolioView TM.

• Within its modelling framework, rating transition matrices are functionally related to the

state of the economy, as the matrices are modified to give an increased likelihood of an

upgrade (and decreased likelihood of a downgrade) during an upswing (downswing) in a

credit cycle.

• This qualitative phenomenon accords with intuition and is borne out by some research.

14. Portfolio credit risk models can be

classified according to their approaches to

credit risk aggregation:

http://www.globalriskcommunity.com

info@globalriskconsult.com

Copyright © 2011 Global Risk Consult

• Top-down models

• Top-down models group credit risks using single statistics.

• They aggregate many sources of risk viewed as homogeneous into an overall portfolio risk,

without going into the detail of individual transactions.

• This approach is appropriate for retail portfolios with large number of credits, but less so for

corporate or sovereign loans. Even within retail portfolios, top-down models may hide

specific risks, by industry or geographic location.

Bottom-up models

• Bottom-up models account for features of each asset/credit.

• This approach attempts to measure credit risk at the level of each loan based on an explicit

evaluation of the creditworthiness of the portfolio's constituent debtors.

• Each specific position in the portfolio is associated with a particular risk rating, which is

typically treated as a proxy for its EDF and/or probability of rating migration.

• These models could also utilize a micro approach in estimating each instrument's LGD. The

data is then aggregated to the portfolio level taking into account diversification effects.

• It is appropriate for corporate and capital market portfolios.

15. Correlation between credit events

http://www.globalriskcommunity.com

info@globalriskconsult.com

Copyright © 2011 Global Risk Consult

• In measuring credit risk, the calculation of a measure of the dispersion of credit risk

requires consideration of the dependencies between the factors determining credit-related

losses, such as correlations among defaults or rating migrations, LGDs and exposures, both

for the same borrower and among different borrowers.

• These correlations, and the methodology to calculate them in a given credit model, can

have a major effect on the loss distribution of a portfolio and is a key difference between

the credit models.

16. Approaches for handling

default/rating migration correlations

http://www.globalriskcommunity.com

info@globalriskconsult.com

Copyright © 2011 Global Risk Consult

• Structural approach

• Structural approach explains correlations by the joint movements of assets.

• For instance, A customer may be assumed to default if the underlying value of its assets falls below some

threshold, such as the level of the customer's liabilities; or

• A change in a customer's risk rating can be determined by the change in the value of his assets in relations

to various thresholds.

• In both these cases some random variables have been used to determine the change in the customer's risk

rating including defaults. These variables are called migration risk factors.

• This approach is used by models like CreditMetrics and PortfolioManager.

• Reduced-form approach

• Reduced-form models explain correlations by assuming a particular functional relationship between default

and 'background factors'.

• These background factors may represent either:

• Observable variables, such as indicators of macroeconomic activity, or unobservable random risk factors.

• Within reduced-form models, it is the dependence of the financial condition of individual customers on

common or correlated background factors that gives rise to correlations among customers' default rates

and rating migrations.

• This approach is used by models like CreditRisk+ and CreditPortfolioView

17. Risk aggregation and its

stakeholders

http://www.globalriskcommunity.com

info@globalriskconsult.com

Copyright © 2011 Global Risk Consult

18. Factoring macroeconomic impact on

Credit and Valuation Models

http://www.globalriskcommunity.com

info@globalriskconsult.com

Copyright © 2011 Global Risk Consult

• Calculate macroeconomic correlations to fundamental data

• Understand the correlations between fundamental financial data and a

set of macroeconomic variables, commodity prices, foreign exchange

rates and interest rates

• Monitor those correlations for convergence/divergence

• Look for warning signs such as increasing correlations

• Use the correlations to forecast fundamentals and feed models

• Use the correlations to forecast financials to feed a range of macro and

fundamentally based credit models, equity valuation models and so

forth

• Then, perform economic shocks and stress testing

– Shock the economic, commodity, and rate variables to provide a

foundational stress testing capability across those models

19. Risk Aggregation Methodologies

http://www.globalriskcommunity.com

info@globalriskconsult.com

Copyright © 2011 Global Risk Consult

Risk aggregation involves the aggregation of individual risk measurements

using a model for aggregation. The model for aggregation can be based

on a simple linear aggregation or using a copula model.

• The linear aggregation model is based on aggregating risk, such as

value at risk (VaR) or expected shortfall (ES), using correlations and

the individual VaR or ES risk measures.

• The copula model aggregates risk using a copula for the co-

dependence, such as the normal or t-copula, and the individual risk’s

profit and loss simulations. The copula model allows greater flexibility

in defining the dependence model than the linear risk aggregation.

20. Risk Aggregation Methodologies

http://www.globalriskcommunity.com

info@globalriskconsult.com

Copyright © 2011 Global Risk Consult

• The simplest method in aggregating different risks and the

corresponding loss distributions is to ignore possible diversification and

netting effects. In other words, this corresponds to making the

assumption that random variables, representing the different risks, are

perfectly correlated. Within this approach, the risk measures are

summed up to obtain the corresponding risk measure for the total loss

distribution.

21. Risk Aggregation Methodologies

http://www.globalriskcommunity.com

info@globalriskconsult.com

Copyright © 2011 Global Risk Consult

• A more sophisticated and widely used method is the correlation

approach. Within this approach the assumption is that the different

risks and corresponding random variables are multivariate normal; that

is, assume that the dependence structure can be described by the

dependence between the margins of a multivariate Gaussian

distribution. Furthermore, the individual distributions are assumed to

be normally distributed—an assumption that, depending on the actual

distribution, can introduce a questionable distortion.

• The problem of assuming normally distributed risk components is

circumvented if one uses the copula approach. While the individual

risks can be modeled independently of each other, one also has the

freedom to model the dependence structure separately.

25. Risk aggregation and Economic

Capital

http://www.globalriskcommunity.com

info@globalriskconsult.com

Copyright © 2011 Global Risk Consult

26. http://www.globalriskcommunity.com

info@globalriskconsult.com

Copyright © 2011 Global Risk Consult

Risk aggregation and Economic

Capital

• The independent aggregate risk is obtained using zero correlations and

the additive risk is obtained using correlations equal to unity.

• Finally, we also calculate the actual contribution risk as a percentage of

total risk.

• The contribution is the actual risk contribution from the sub-risks

obtained in the context of the portfolio of total risks1. This risk

contribution is often compared with standalone risk to obtain a

measure of the diversification level.

• For example, the market risk sub-risk has a standalone risk share of

16,3 percent whereas the risk contribution share is 11,89 percent. This

represents a diversification level of about 73 percent compared to the

simple summation approach.

28. http://www.globalriskcommunity.com

info@globalriskconsult.com

Copyright © 2011 Global Risk Consult

Pros and Cons of the linear model

• The linear model of risk aggregation is a very convenient model

to work with. The only data required is the estimates of the

sub-risks’ economic capital and the correlation between the sub-

risks.

• However, the model also has some serious drawbacks. For

example, the model has the assumption that quantiles of

portfolio returns are the same as quantiles of the individual

return – a condition that is satisfied in case the total risks and

the sub-risks come from the same elliptic density family.

• The linear risk aggregation model is the aggregation model used

in the capital regulations for the standard approach

29. http://www.globalriskcommunity.com

info@globalriskconsult.com

Copyright © 2011 Global Risk Consult

Copula-Based Risk Aggregation

While linear risk aggregation only requires

measurement of the sub-risks, copula methods of

aggregation depend on the whole distribution of the

sub-risks.

• Benefit 1: allows the original shape of the sub-risk

distributions to be retained.

• Benefit 2: allows for the specification of more general

dependence models than the normal dependence

model.

33. http://www.globalriskcommunity.com

info@globalriskconsult.com

Copyright © 2011 Global Risk Consult

Risk aggregation and estimation of overall risk is

key in banks’ approaches to economic capital and

capital allocation.

• The resulting capital also forms the basis for banks’ value-based management of

the balance sheet.

• When estimating aggregate capital, one typically uses a combination of bottom-

up and top-down risk aggregation approaches.

34. http://www.globalriskcommunity.com

info@globalriskconsult.com

Copyright © 2011 Global Risk Consult

Considerations in designing Liquidity Risk Stress

Scenarios

Utilize integrated approach when developing scenario specifications

̶ Leverage subject matter experts across various disciplines, including but

not limited to Economics, Credit, Market and Operational Risk, and Finance

̶ Assess cash flow implications related to key liquidity risk drivers

Consider different degrees of severity by varying scenarios’ duration and impact

levels

Consider relationships between risk drivers

̶ Leverage combination of subject matter expert judgement and observed

quantitative relationships

Ensure management reviews results

̶ Assess results against established risk appetite and take actions to

remediate accordingly

35. http://www.globalriskcommunity.com

info@globalriskconsult.com

Copyright © 2011 Global Risk Consult

Stress Testing best Practices

Know your business and inherent liquidity risk drivers

̶ Institution complexity and level of exposures should drive stress

testing framework and cash flow modeling assumptions

Use a variety of stress scenarios, time horizons and severity

levels

̶ Stress testing should be run on a regular basis

̶ As the operating stage becomes more severe, frequency of testing

should increase

Conduct regular review of stress testing outcomes to ensure

alignment with the established liquidity risk appetite

̶ Any liquidity gaps exceeding risk tolerance merit remedial action

̶ Results should be integrated with the firm’s contingency funding

planning

36. Contingency Funding Planning Best Practices

Contingency funding plans provide clarity during deteriorating

liquidity conditions

̶ Robust CFPs clarify strategies, roles and responsibilities when total focus

should be given to mitigating the firm’s exposure to potential or realized

adverse liquidity conditions

̶ Management should assess the operating stage and execute the

applicable remediating actions

̶ Fully integrated with stress testing framework

Know your business and available sources of liquidity

̶ Considers existing sources of liquidity and whether it is sufficient to fund

normal operating requirements under stress events

̶ Identifies potential alternative contingent liquidity sources

̶ Considers the firm’s specific legal, regulatory, and tax related

encumbrances to available sources of liquidity

37. http://www.globalriskcommunity.com

info@globalriskconsult.com

Copyright © 2011 Global Risk Consult

Contingency Funding Best practices

Robust CFPs ensure effective communication

̶ Internal and external stakeholders should be considered in the CFP

process

̶ Implementation and escalation procedures should be clearly defined

CFPs should be reviewed on a regular basis to ensure

relevance to the risks to which the firm is exposed

̶ In addition, simulations of the plan should be enacted to test

coordination, decision-making, and operational execution ability

39. http://www.globalriskcommunity.com

info@globalriskconsult.com

Copyright © 2011 Global Risk Consult

Basel III shock scenario components

• The LCR goes much further than just reflecting the characteristics of funding. In

particular, it recognizes the liquidity effects that can stem from trading book and

derivative exposures in a stress period. As security prices and interest rates

become more volatile, so margin/collateral requirements can drain liquidity or

access to unencumbered high-quality liquid assets.

40. http://www.globalriskcommunity.com

info@globalriskconsult.com

Copyright © 2011 Global Risk Consult

What the stress test captures

• Many contracts have triggers that require more collateral to be posted if the

institution is downgraded. This will put downward pressure on the available stock

of liquid high quality assets. The stress test also captures pressures from

balance sheet growth because, in a period of market stress, committed lines are

likely to be drawn down.

• The test does differentiate between different types of commitment. There is a

significant difference in drawdown assumptions for credit facilities and liquidity

facilities. Liquidity facilities are defined as any committed, undrawn back-up

facility put in place expressly to refinance the debt of a customer in situations

where the customer is unable to obtain its ordinary course of business funding

requirements (e.g., commercial paper program).

41. http://www.globalriskcommunity.com

info@globalriskconsult.com

Copyright © 2011 Global Risk Consult

What the stress test captures

• Working capital facilities are classified as credit facilities, rather than liquidity

facilities. With the exception of retail and small business customers, the LCR

assumes 100% drawdown of liquidity facilities. Retail and small business

committed credit and liquidity lines are thought less likely to be drawn down

(e.g., credit card limits) than lines given to other customers and, therefore, a 5%

drawdown factor is applied.

• As discussed, for all other types of customers, committed liquidity lines are

assumed to be fully drawn. A drawdown factor of 10% is applied for credit

facilities for nonfinancial corporates, sovereigns and central banks, PSEs or

multilateral development banks. For financial institutions and other customers, a

100% drawdown factor for committed credit facilities must be used.

• The stress test also reflects the reality that in the face of potential reputational

damage, a bank could not walk away from some types of commitments even

though the contract may allow it to. One example is the mortgage pipeline for a

mortgage bank. Mortgages will have been approved out over a three-month

period.

42. http://www.globalriskcommunity.com

info@globalriskconsult.com

Copyright © 2011 Global Risk Consult

Data and system challenges

• Although in some markets, the contractual terms may allow the bank to walk away from the

agreement and not provide the mortgage, the reputational damage sustained could make

this option unrealistic. This new liquidity stress testing will pose major data and systems

challenges.

• One difficult area is the tracking of triggers and other aspects of derivatives contracts that

could require more collateral to be posted. Another will be aggregating data across

international organizations; currently, many banks have established systems for managing

liquidity that do not combine all entities and also do not recognize all sources of liquidity

pressure.

• Over and above the regulatory minimum stress test, banks are also required to design and

carry out their own stress tests that should incorporate longer time horizons that are tailored

to their own business profiles. Banks are expected to share the results of these additional

stress tests with supervisors. This, too, will pose challenges.

• Clear policies and procedures will need to be developed to conduct the regulatory stress

tests, design appropriate internal stress tests and provide the necessary governance and

oversight. The output will also have to be embedded in the business.