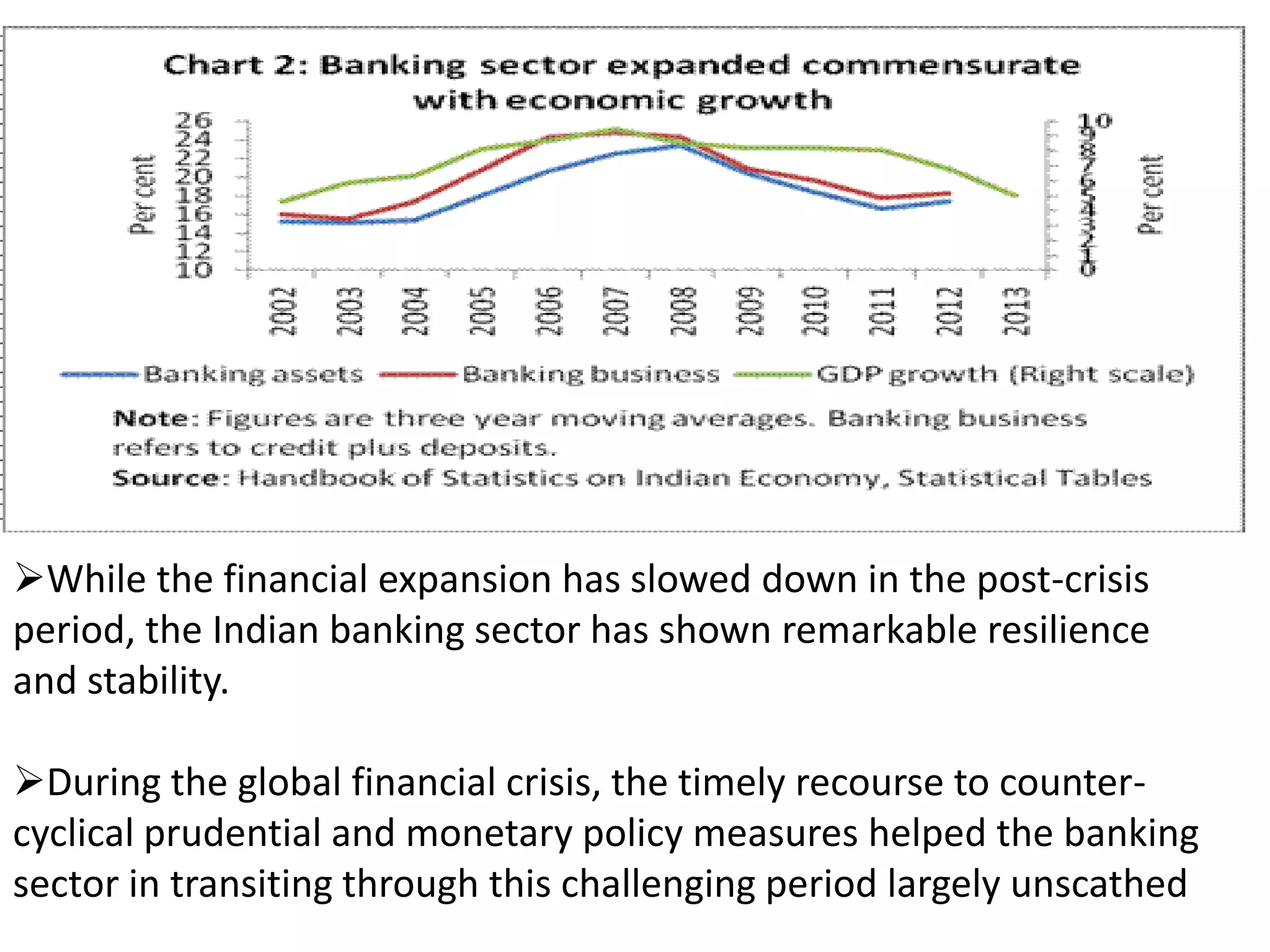

The document provides an overview of the banking industry in India. It discusses key points:

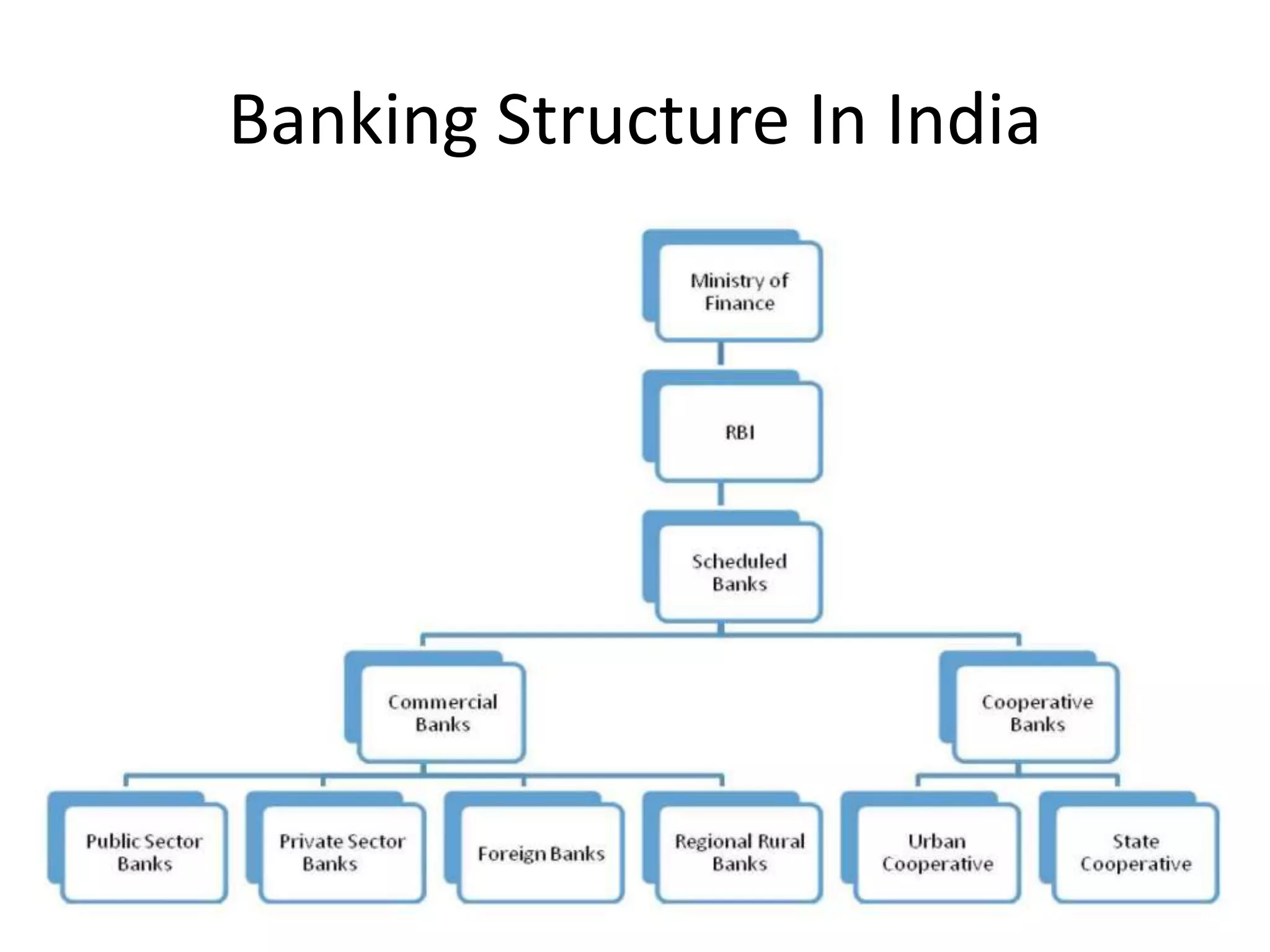

- The Reserve Bank of India (RBI) acts as the central bank and regulates monetary policy, banking supervision, foreign exchange and more.

- India has a multi-tiered banking structure including retail banking for consumers, international banking, and wholesale banking for large corporations.

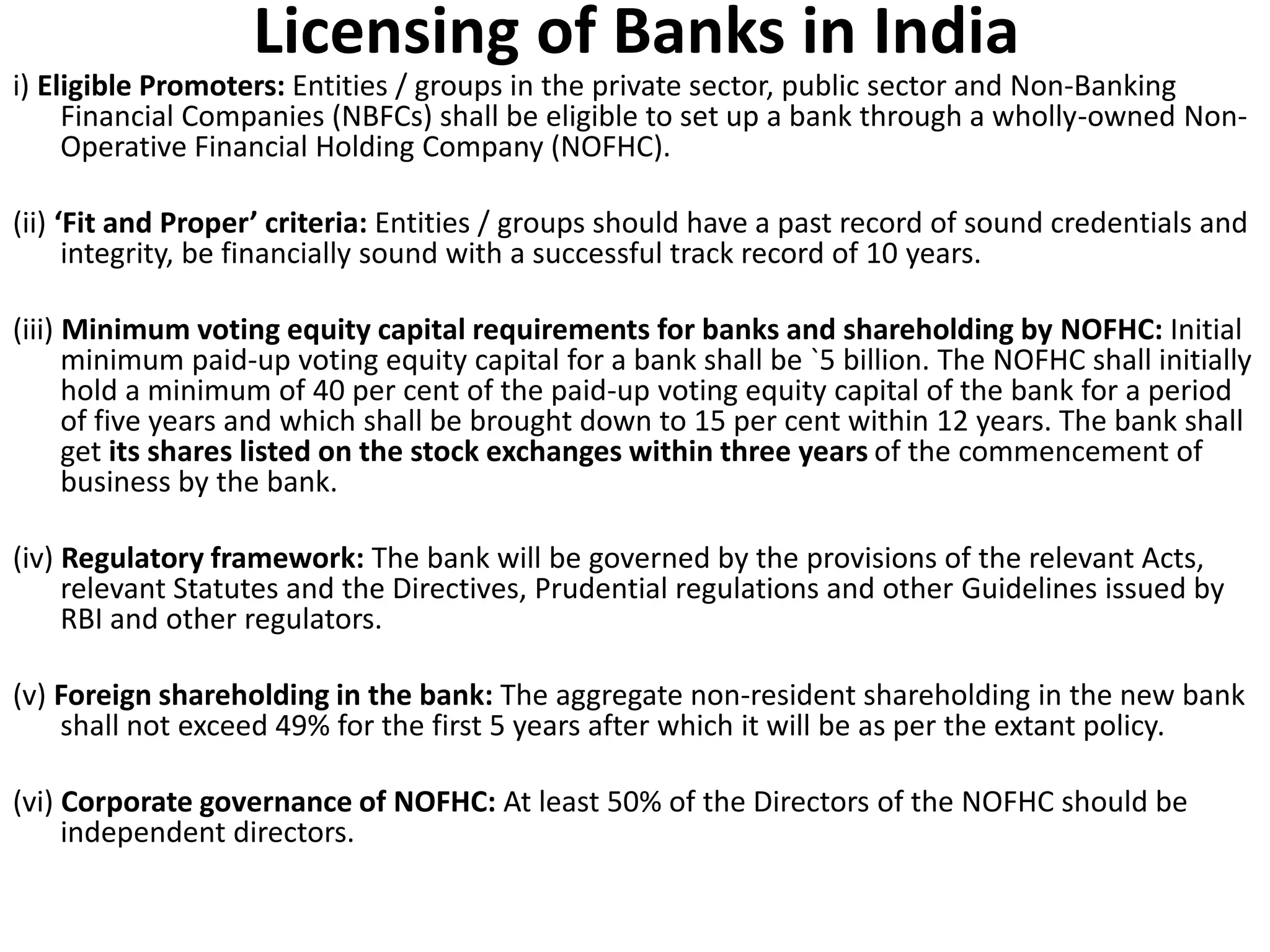

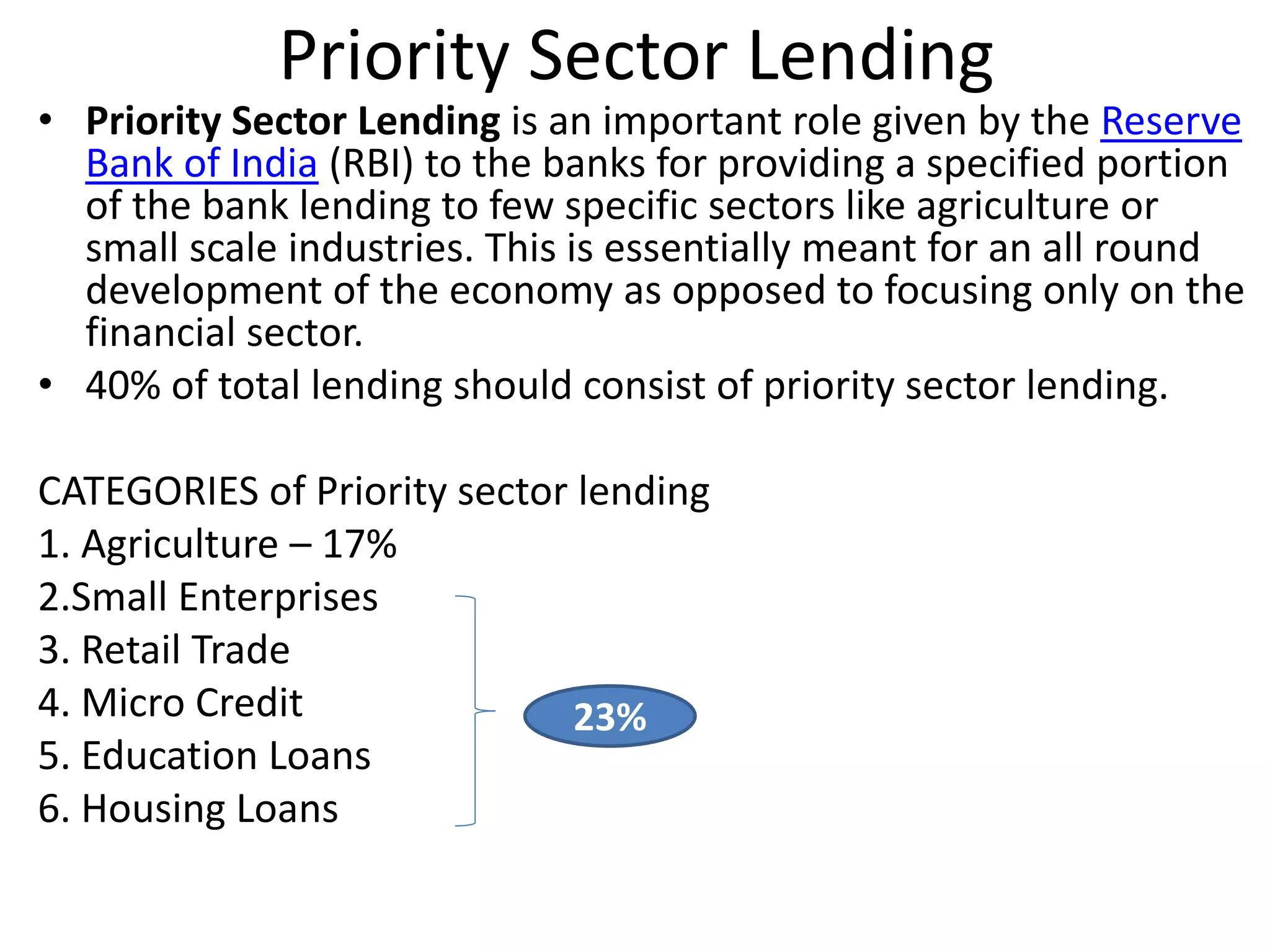

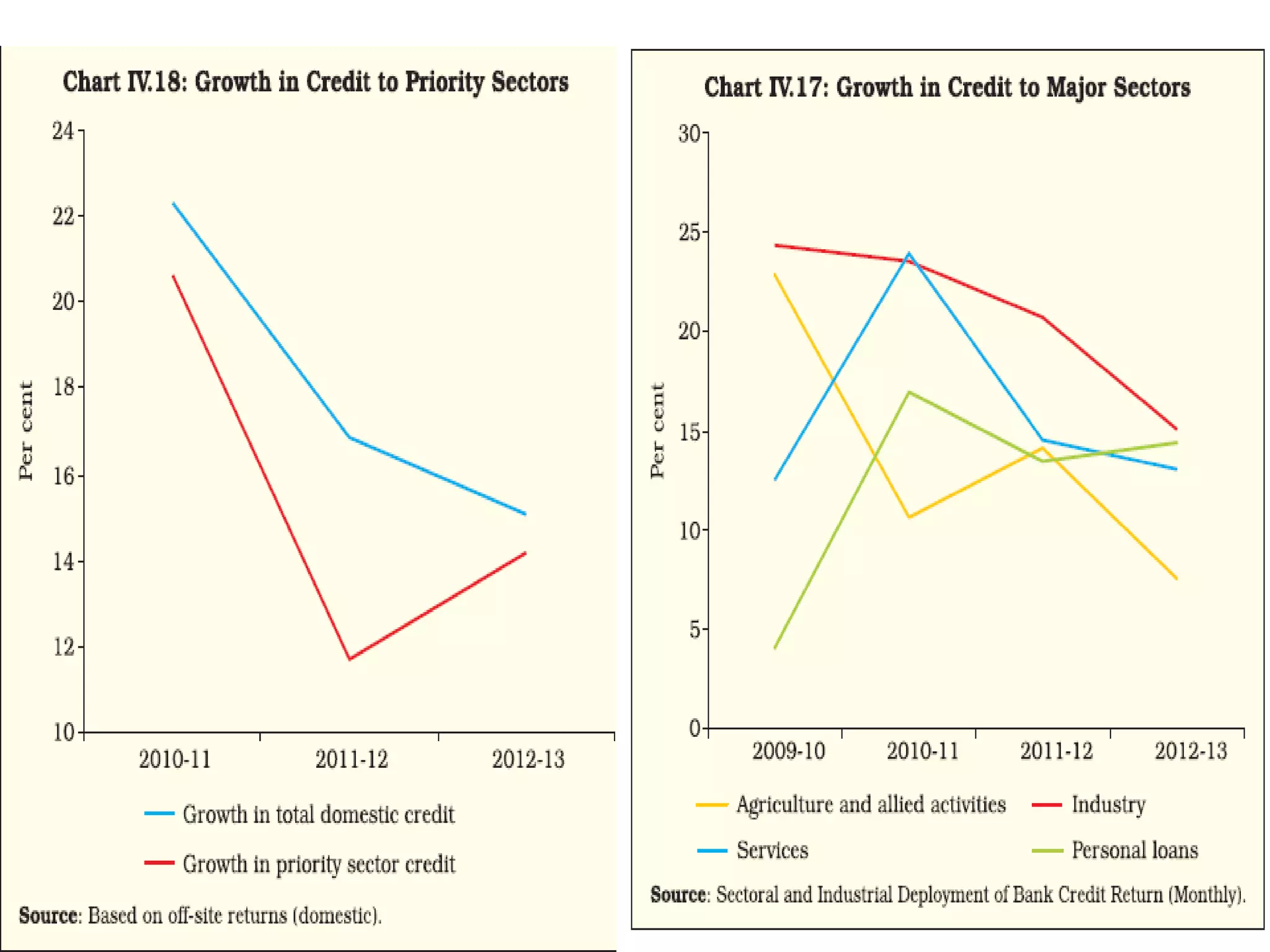

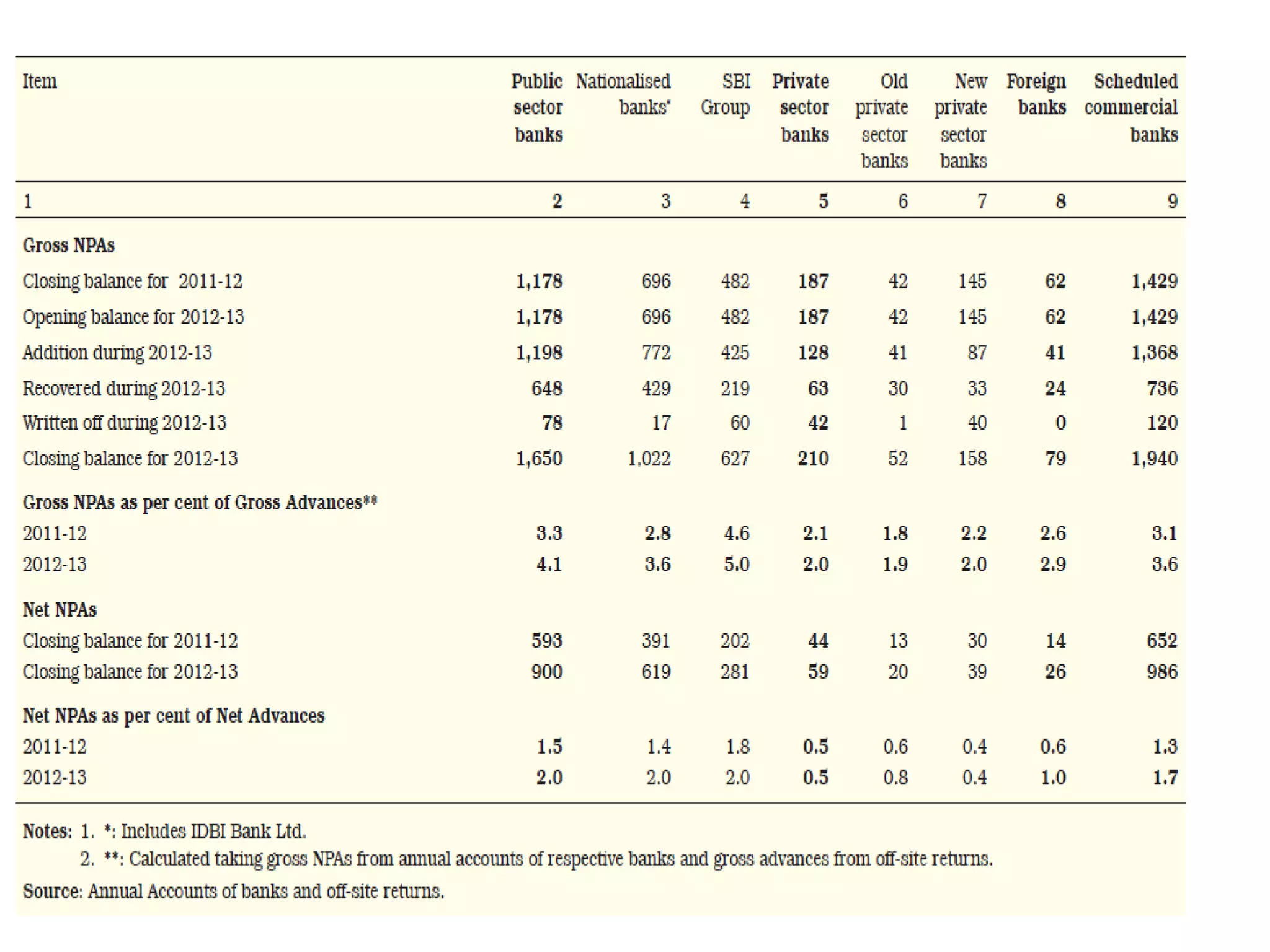

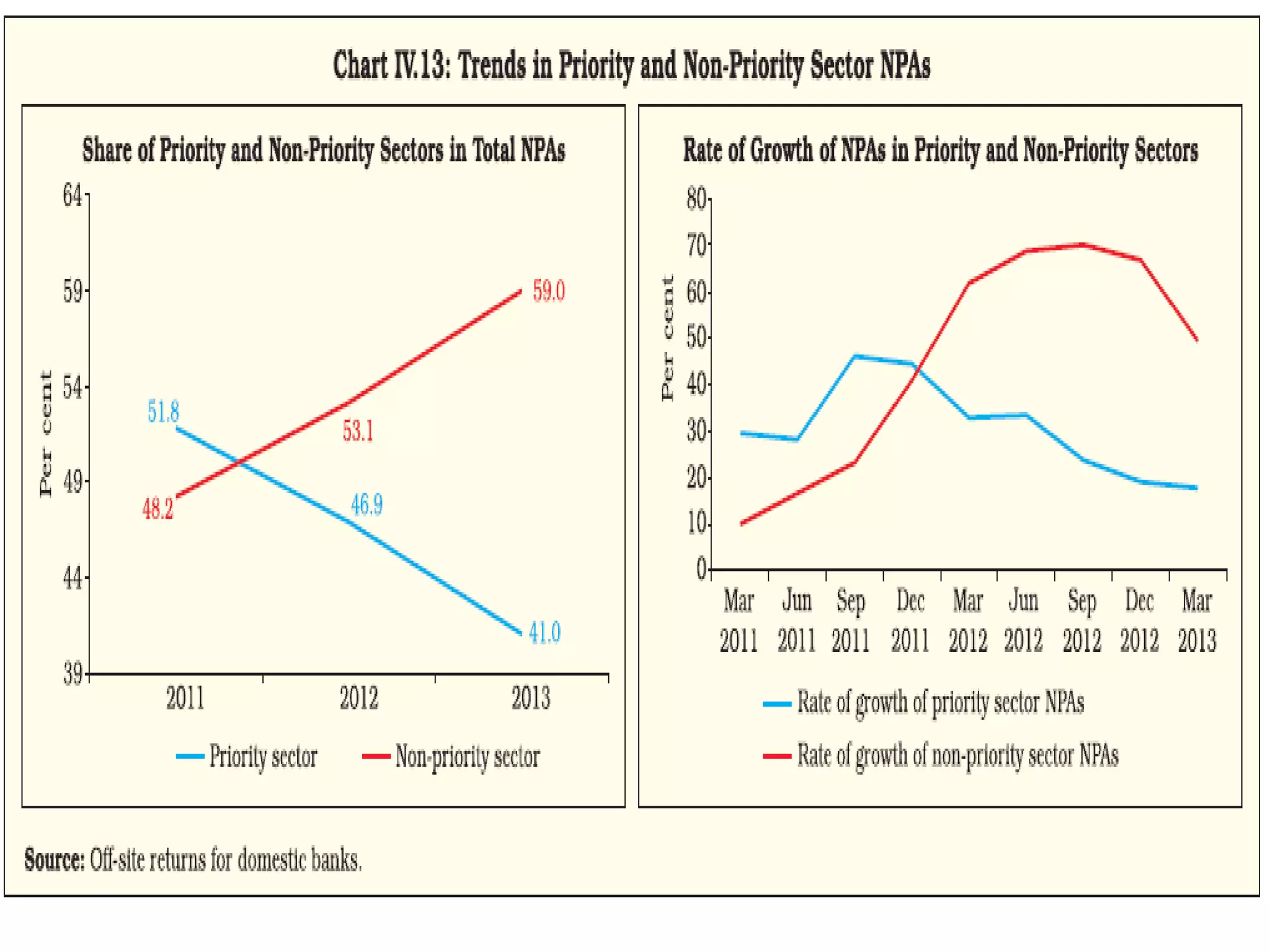

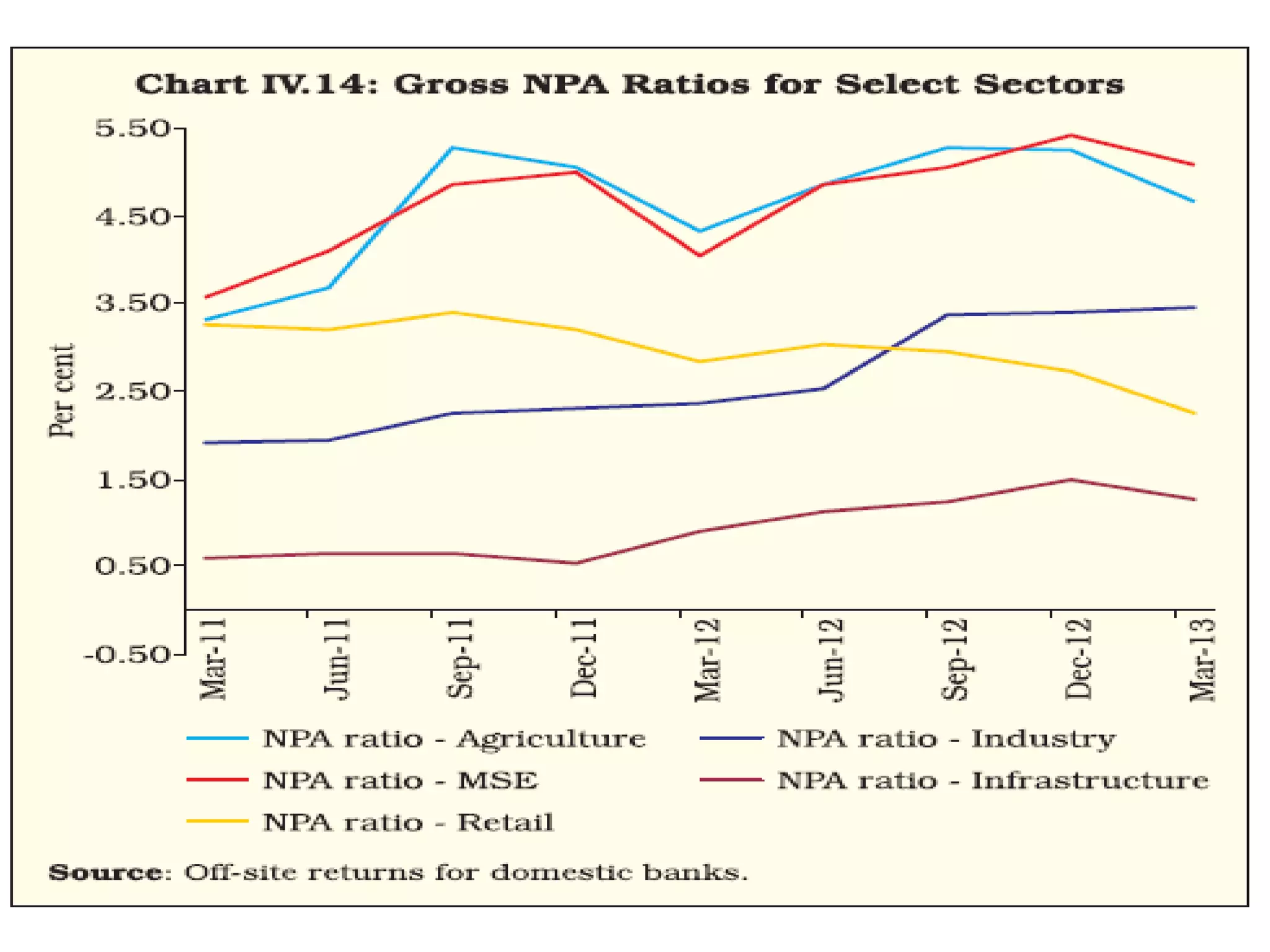

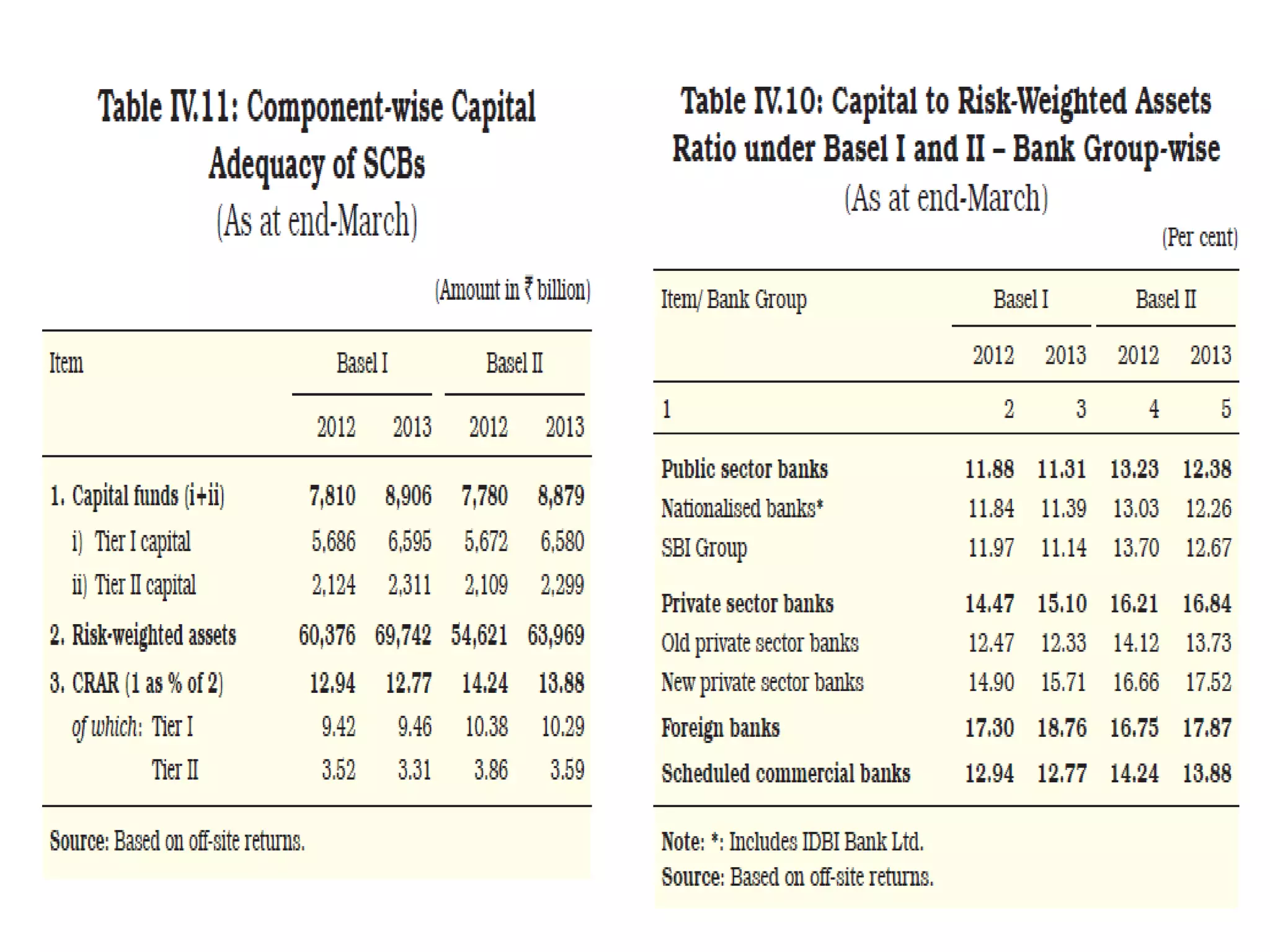

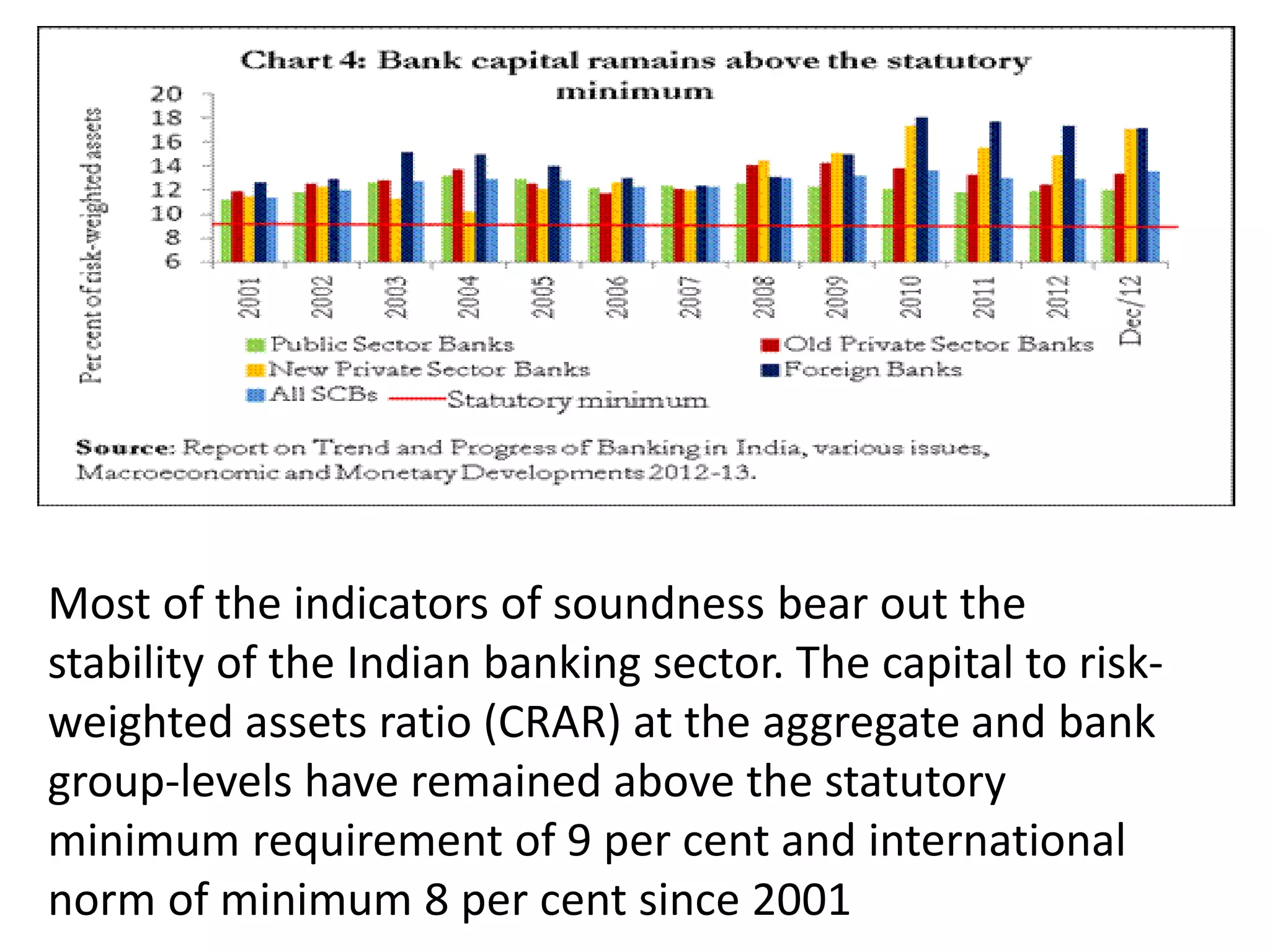

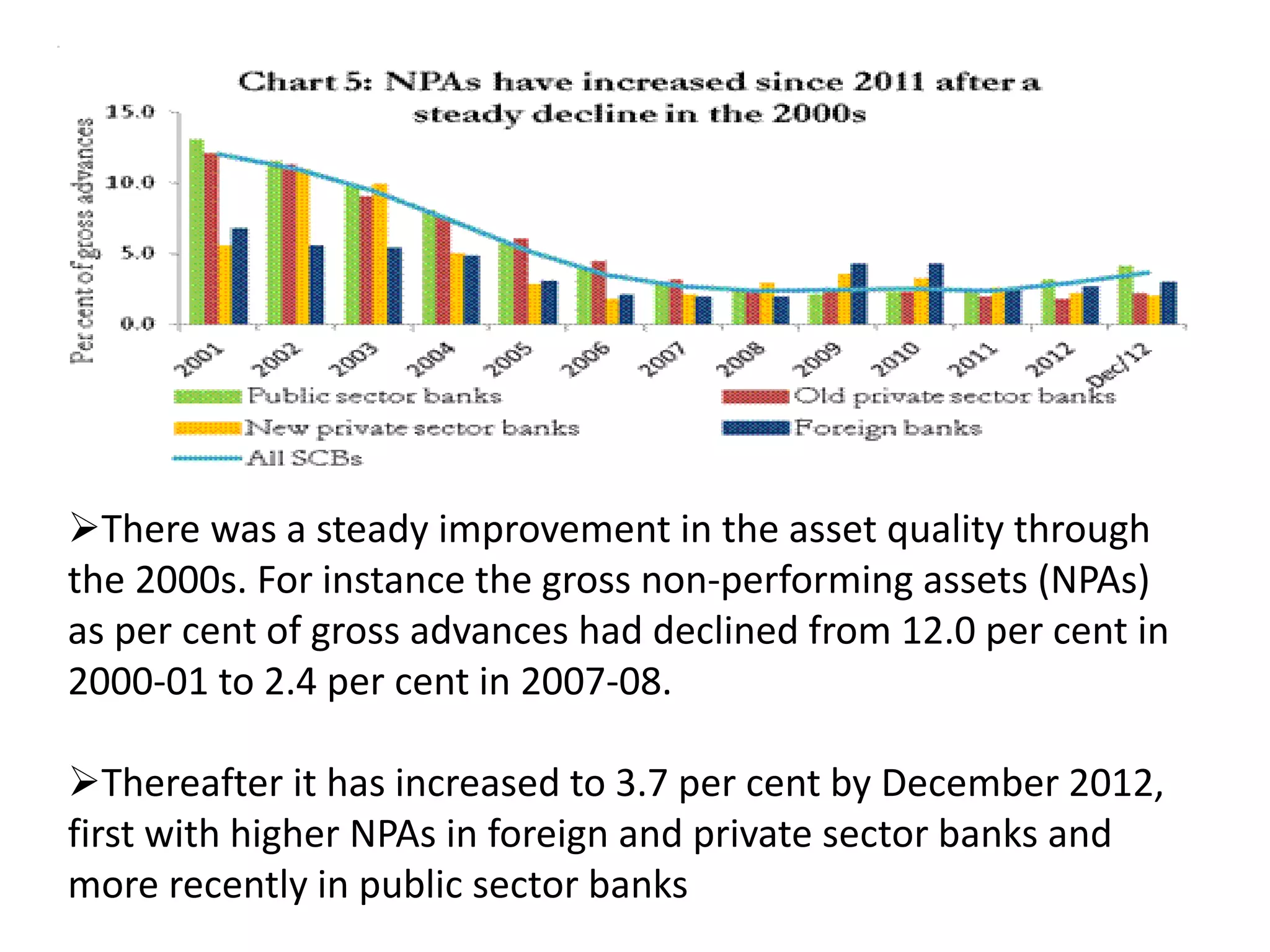

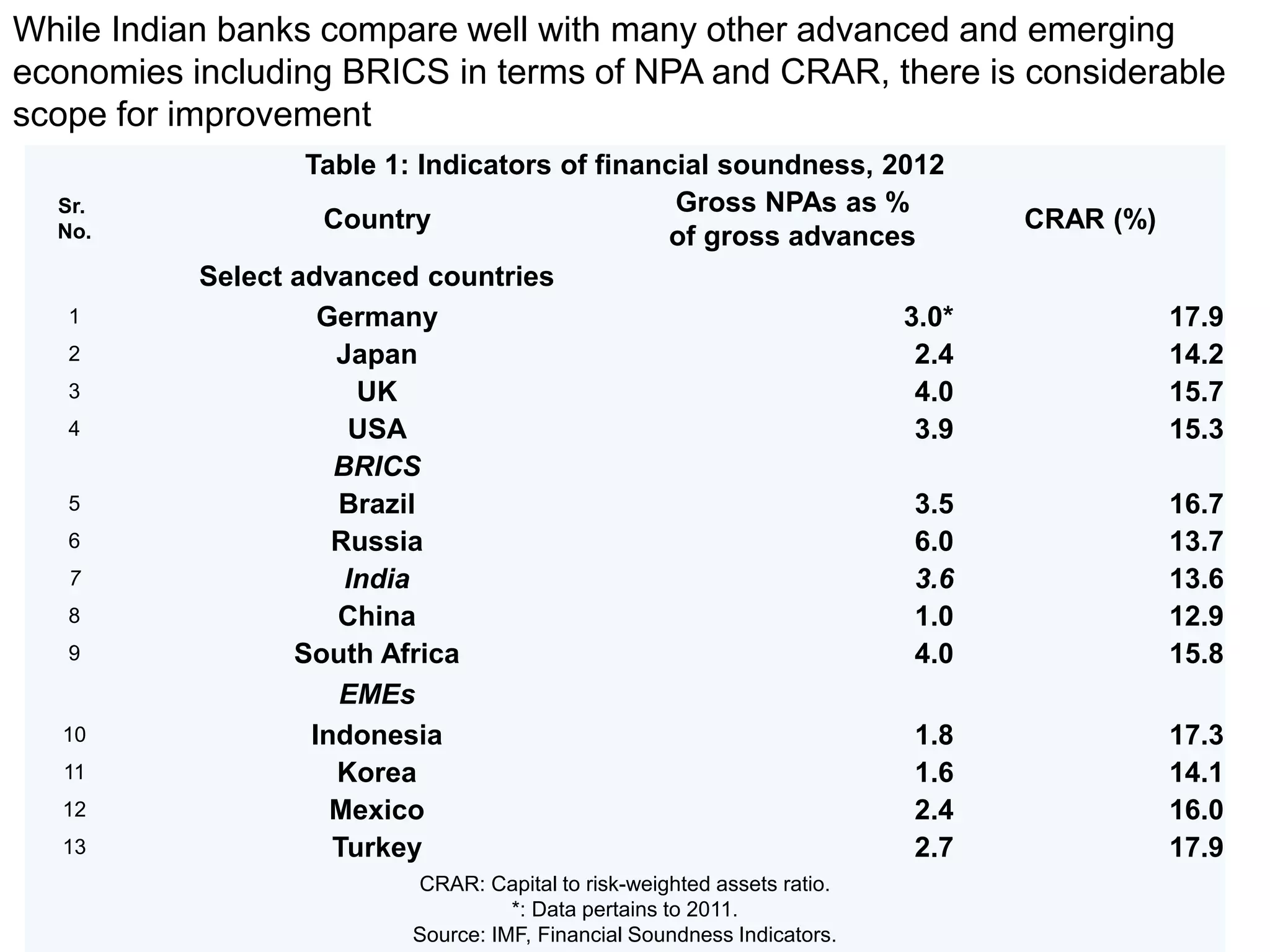

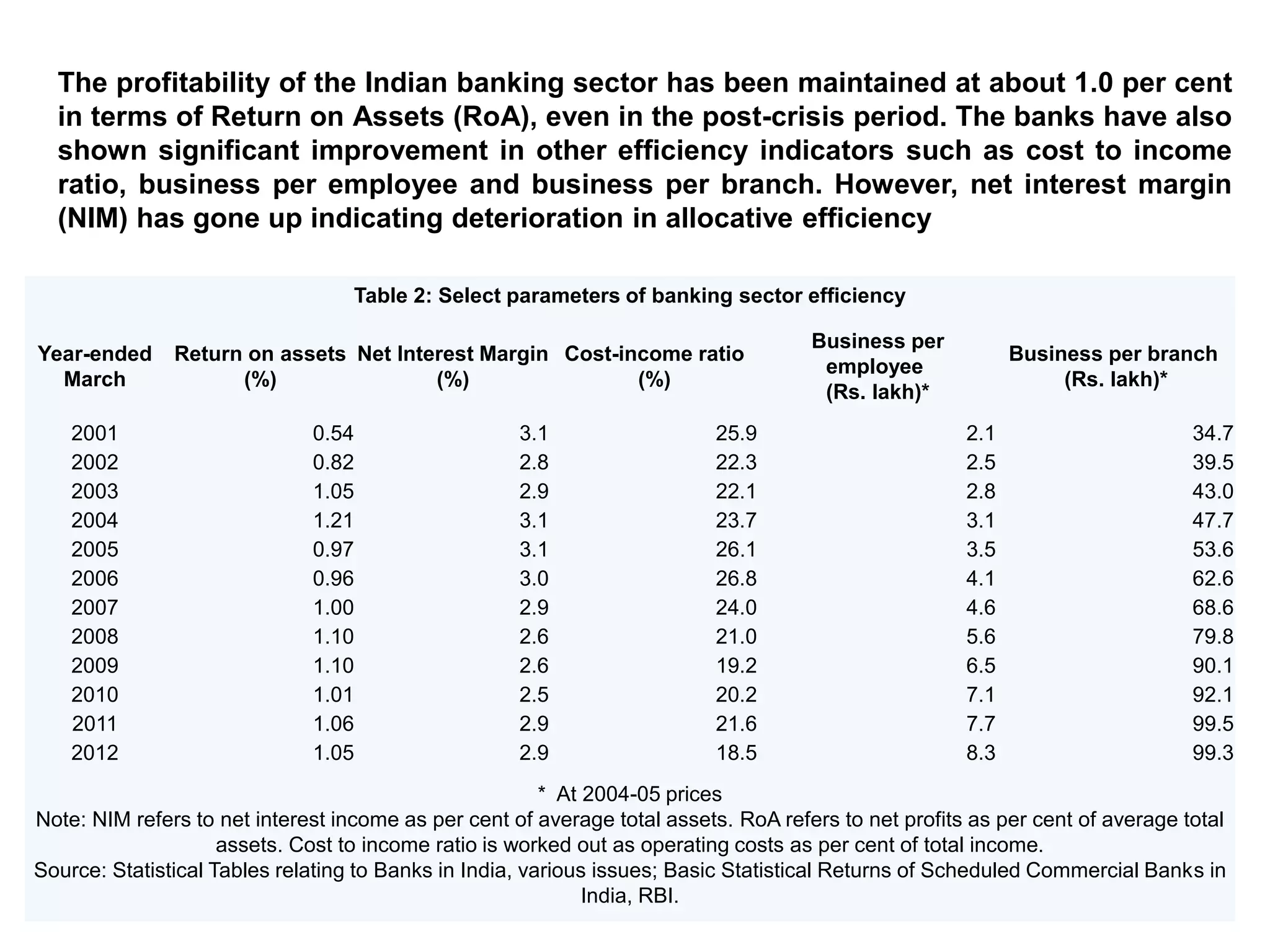

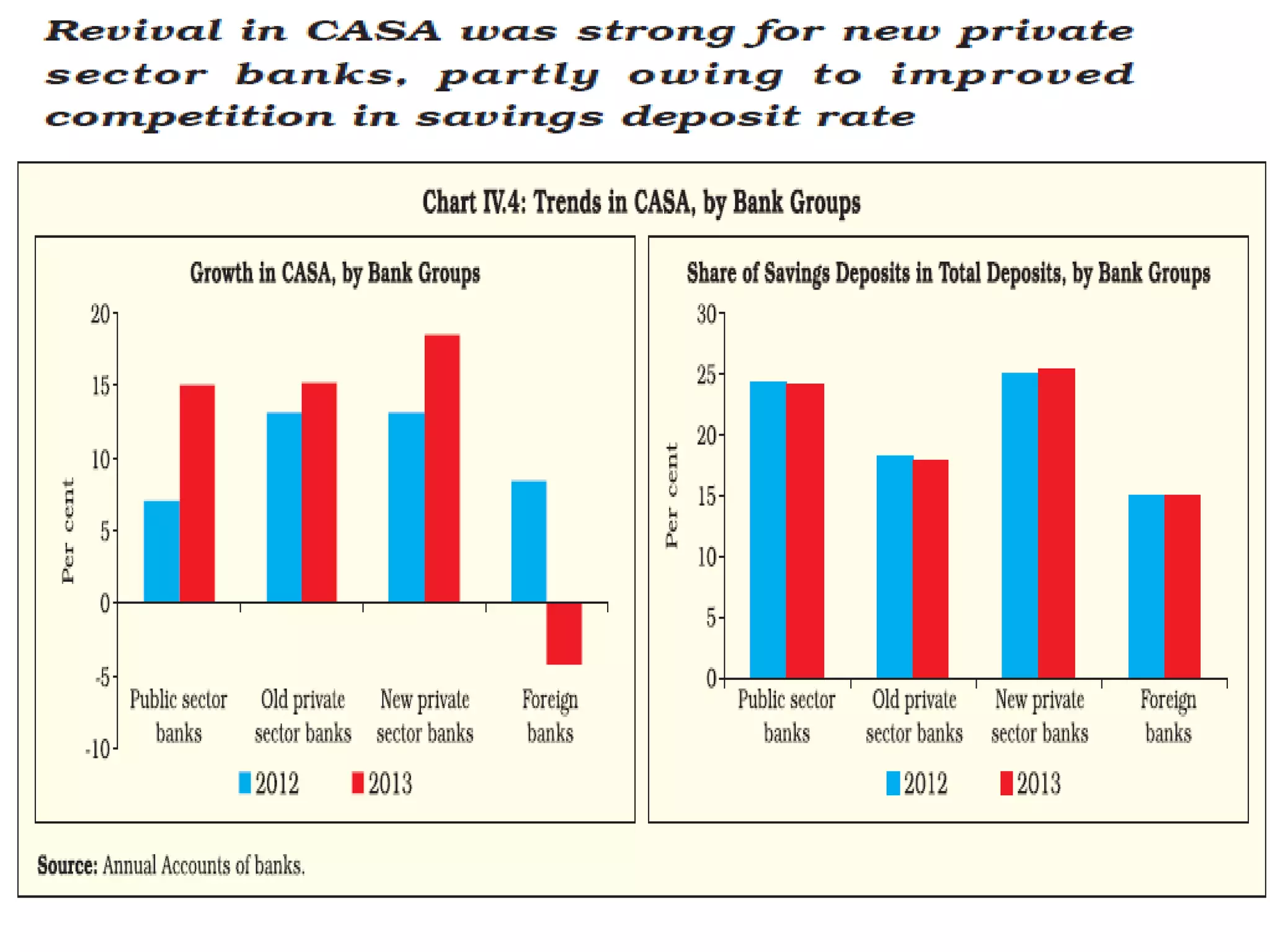

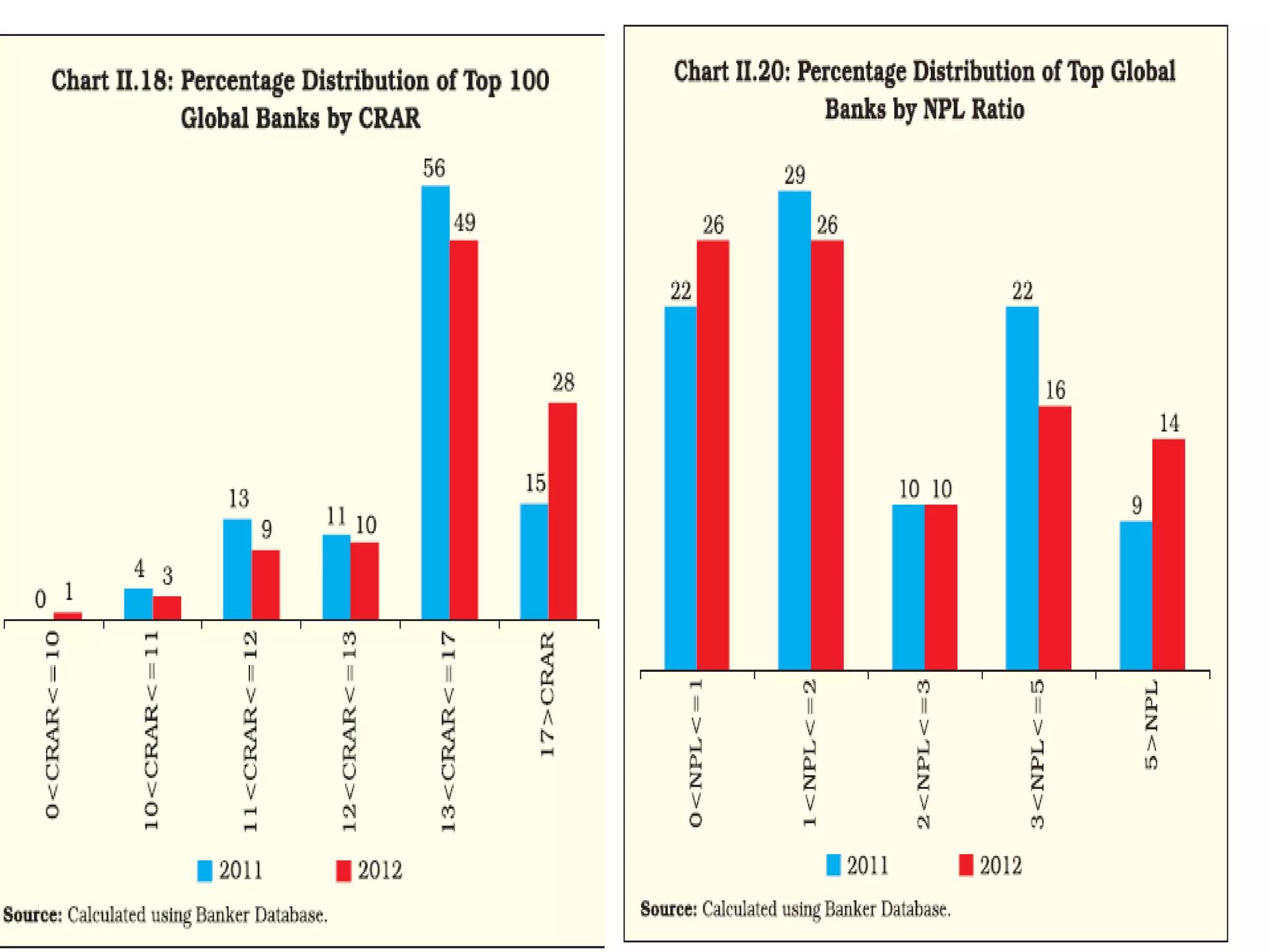

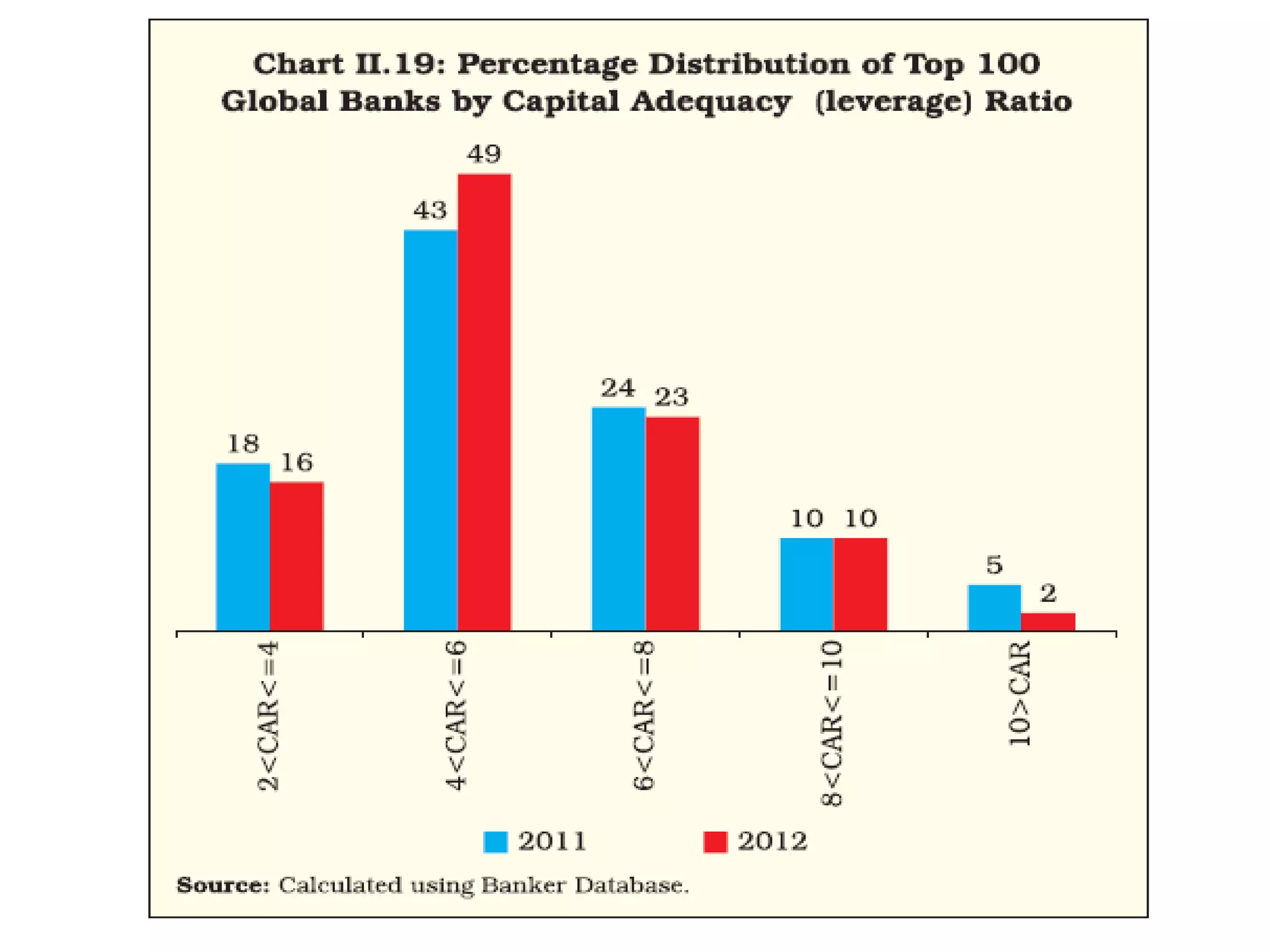

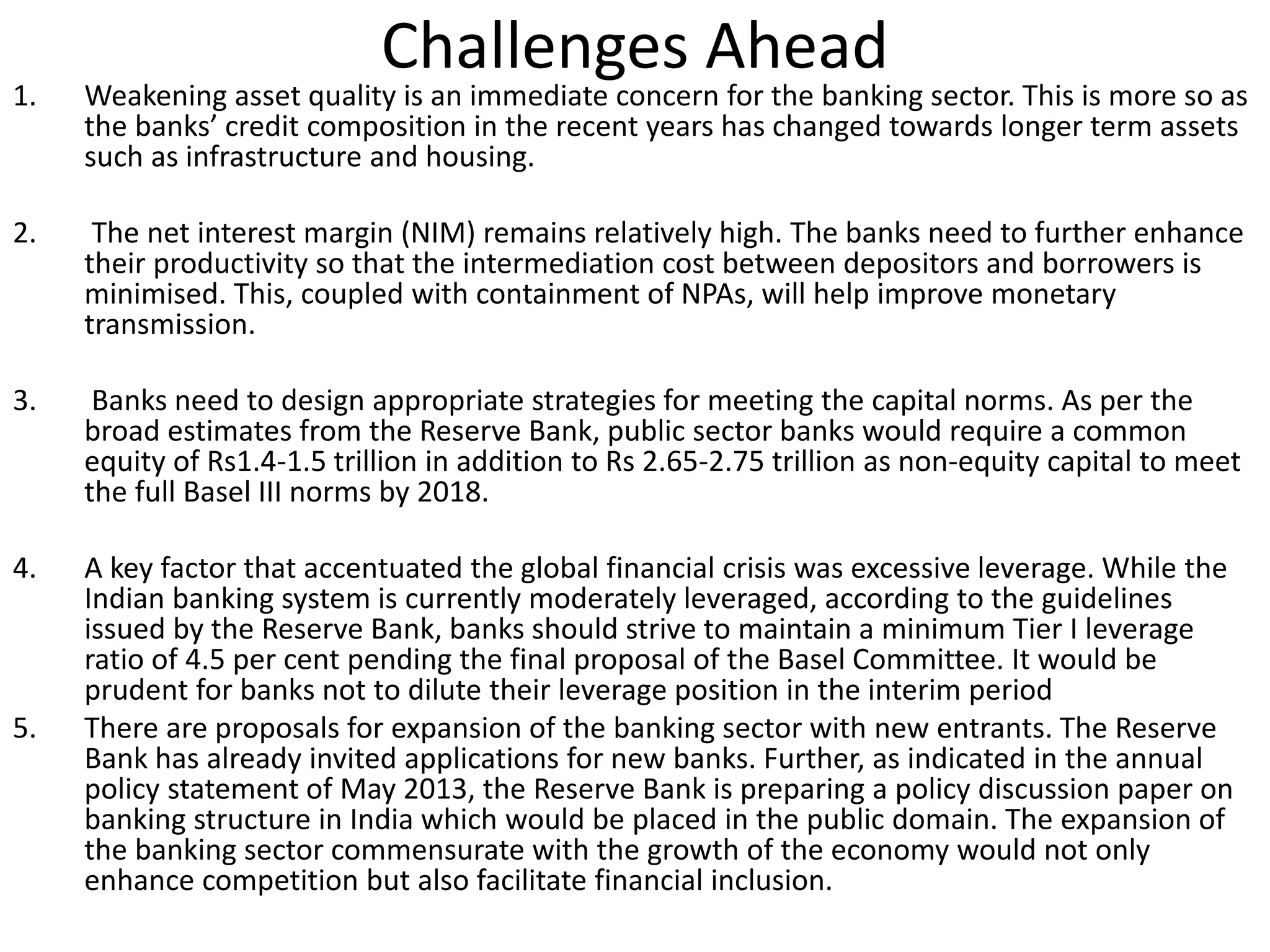

- Banks in India must follow regulations around capital requirements, priority sector lending targets, and controlling non-performing assets.

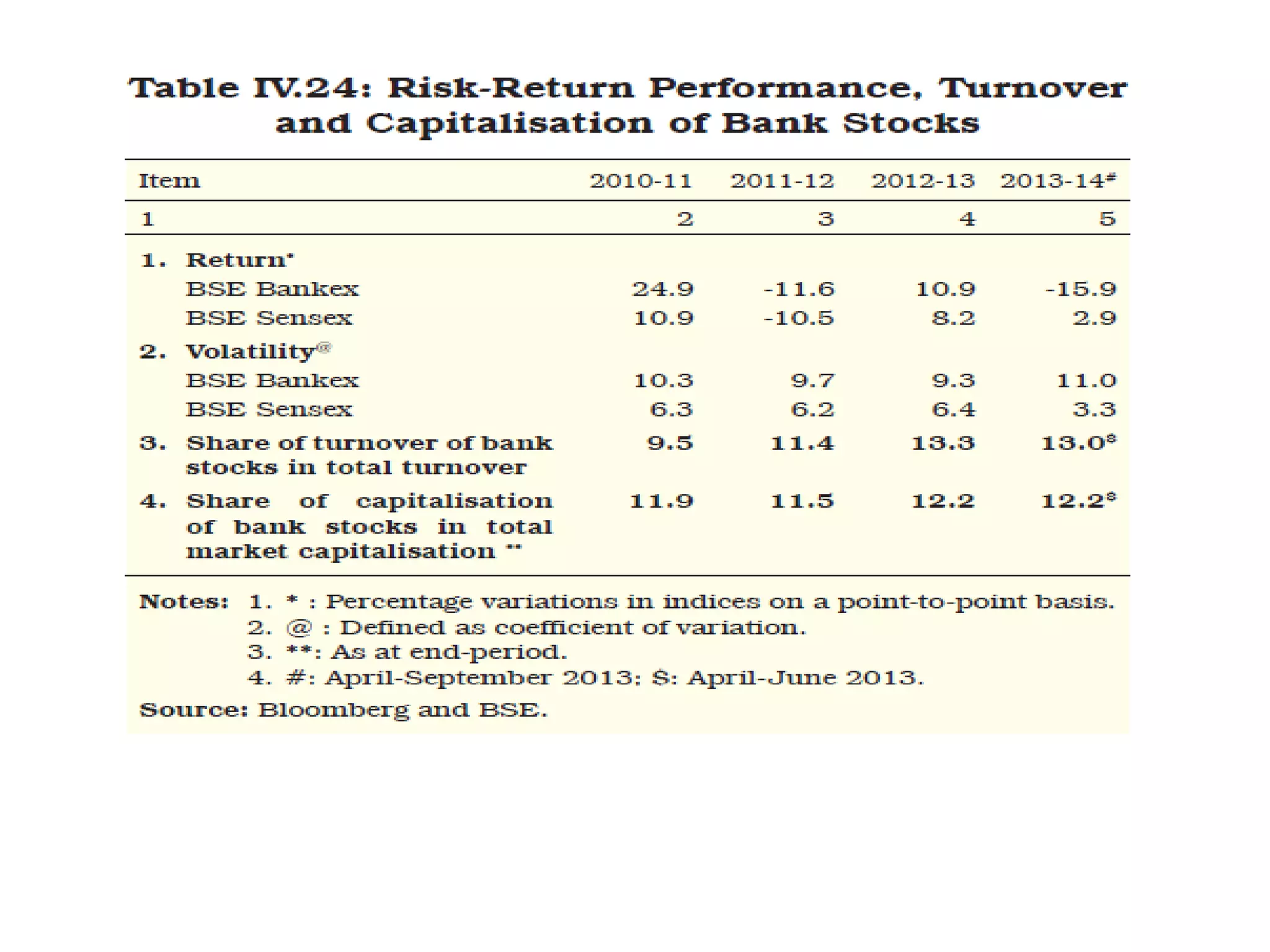

- Performance is measured using metrics like capital adequacy, asset quality, management efficiency, earnings quality, and more.

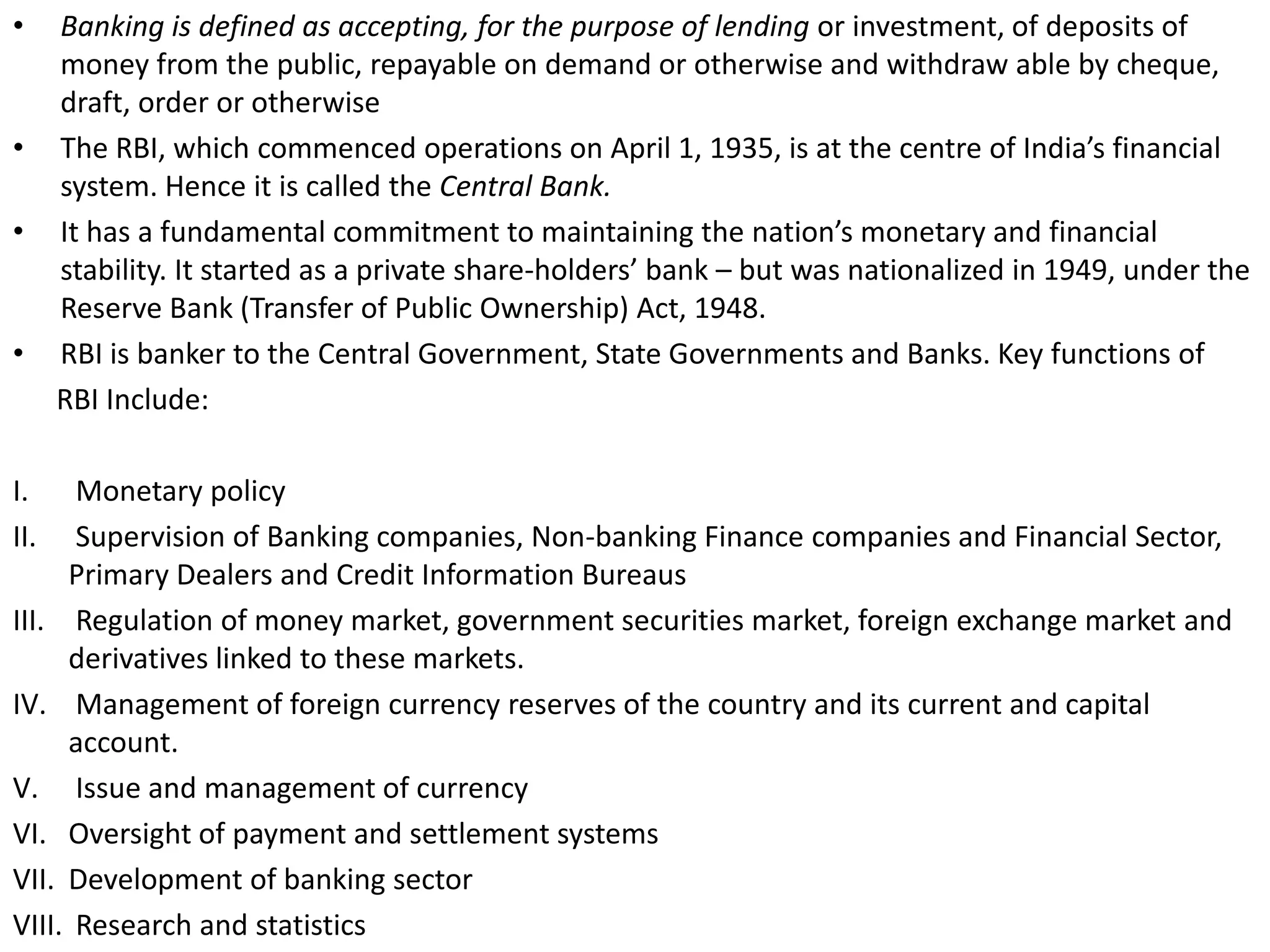

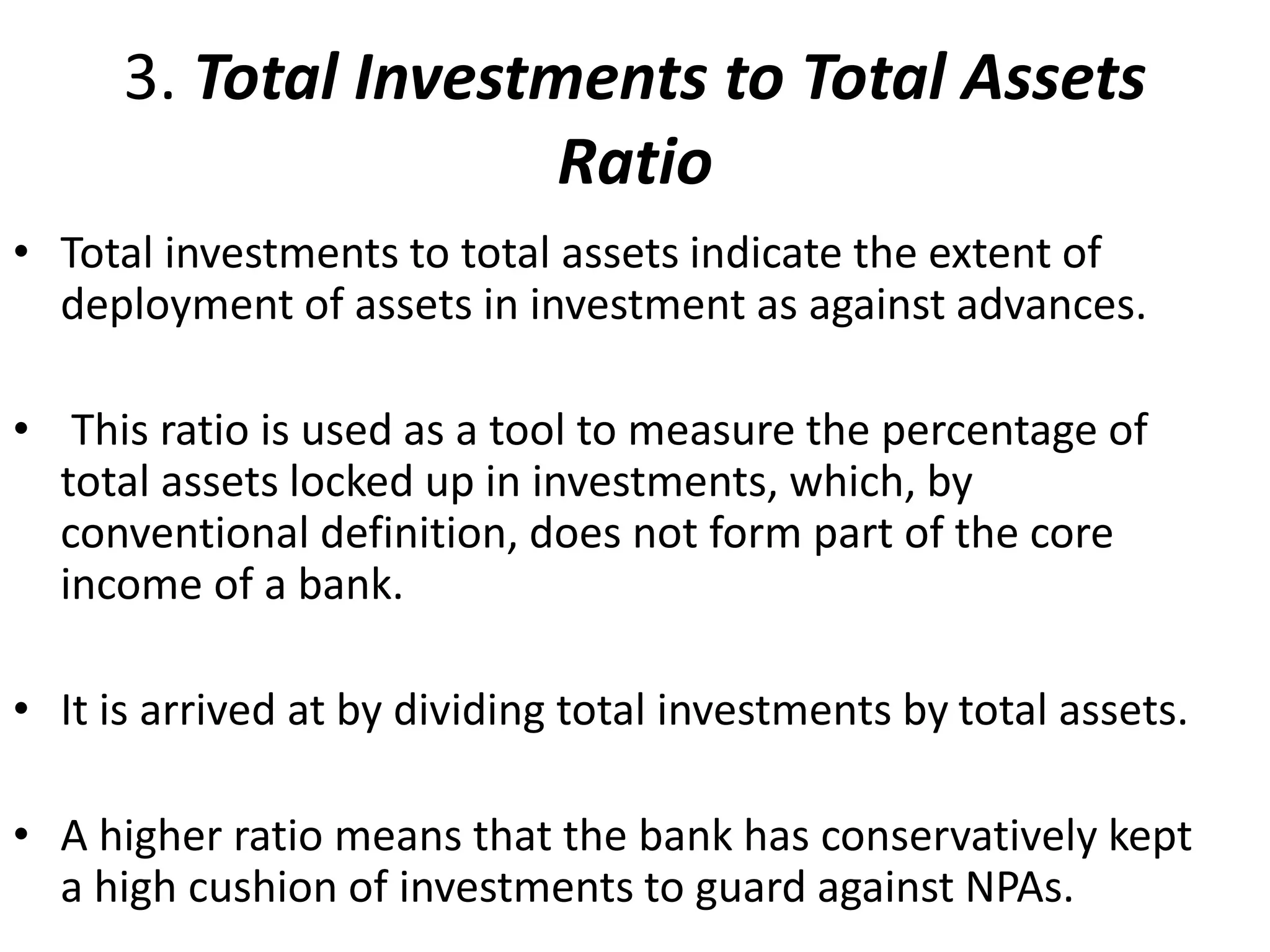

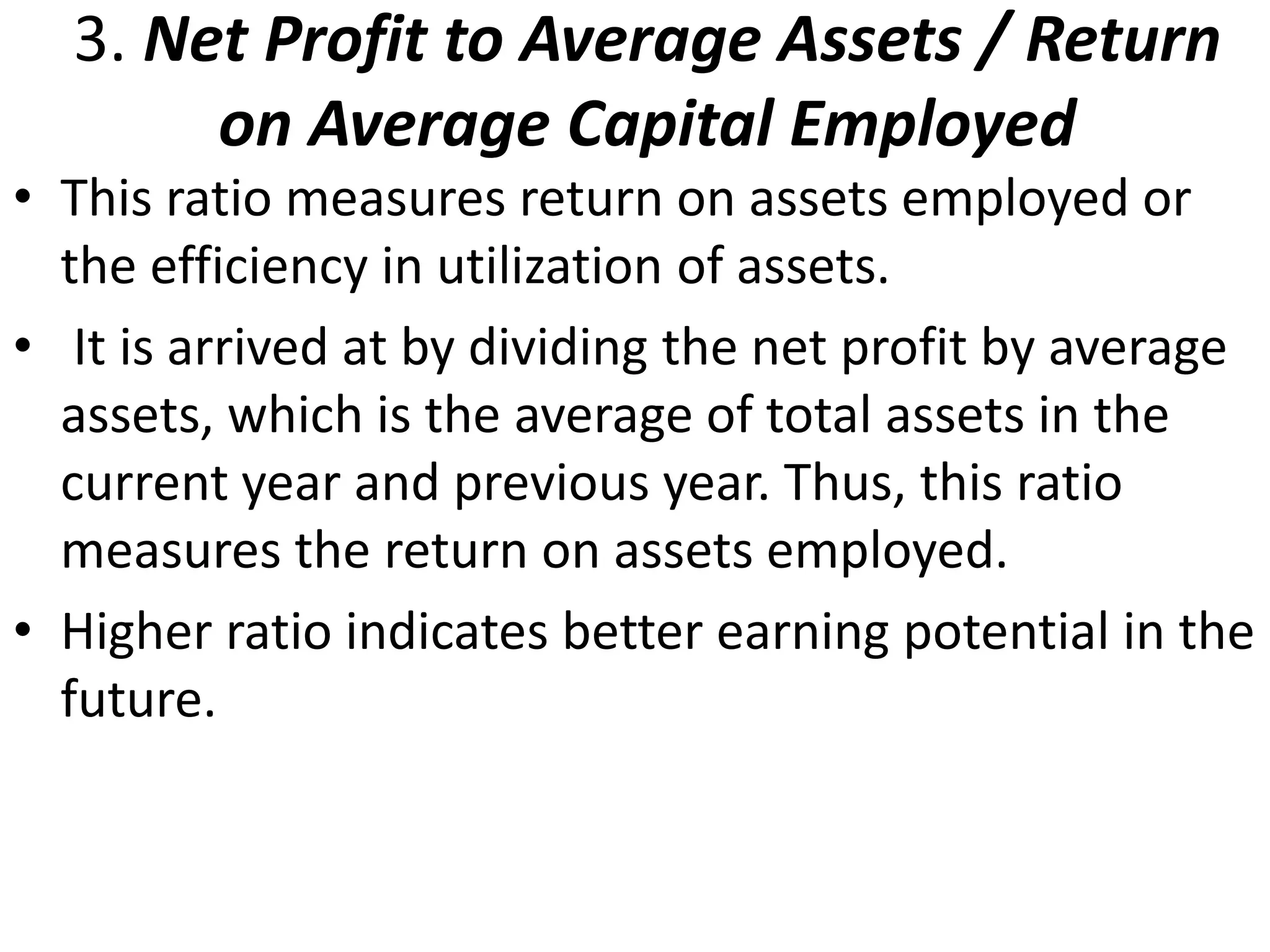

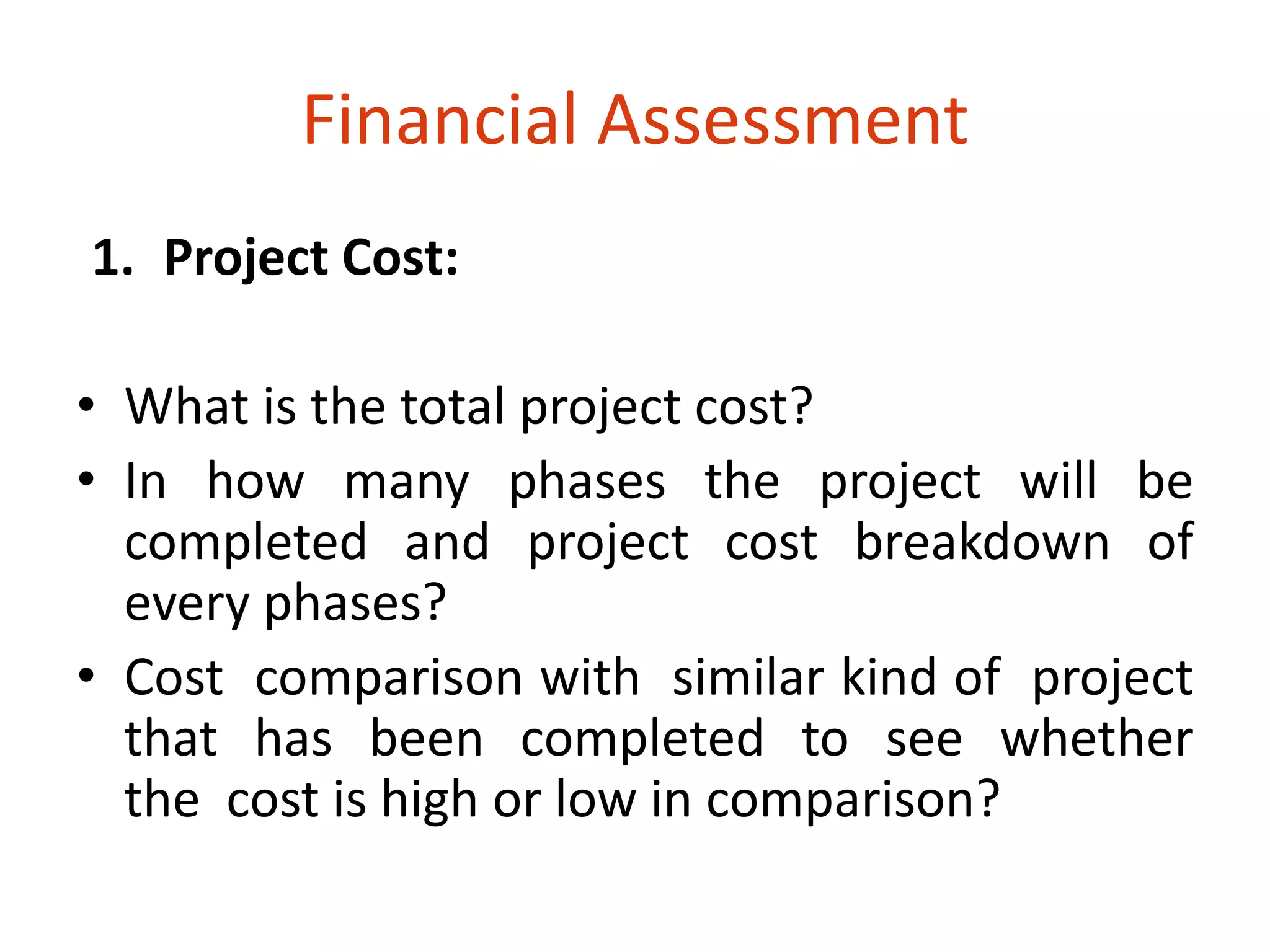

![Assessment of Non-Fund Based limit

• Computation Showing assessment of Letter of Credit

Particular Amount (Rs)

Projected annual purchase of Raw material (A) *****

Projected annual purchase under LC (B) *****

Projected annual purchase under LC C= (A)*(B) *****

Monthly raw material being purchase through LC [(C)

/12] = (D)

*****

Usance Period (month) (E) *****

Lead Period (month) (F) *****

Amount of LC required G= (D)*(F+F) *****](https://image.slidesharecdn.com/bankingindustryinindia-introduction-140918134344-phpapp02/75/Banking-industry-in-india-introduction-84-2048.jpg)