IASB Conceptual Framework 2018 -An Overview

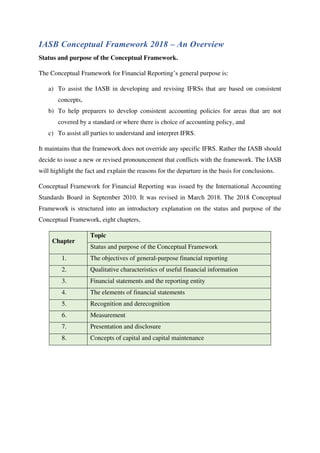

- 1. IASB Conceptual Framework 2018 – An Overview Status and purpose of the Conceptual Framework. The Conceptual Framework for Financial Reporting’s general purpose is: a) To assist the IASB in developing and revising IFRSs that are based on consistent concepts, b) To help preparers to develop consistent accounting policies for areas that are not covered by a standard or where there is choice of accounting policy, and c) To assist all parties to understand and interpret IFRS. It maintains that the framework does not override any specific IFRS. Rather the IASB should decide to issue a new or revised pronouncement that conflicts with the framework. The IASB will highlight the fact and explain the reasons for the departure in the basis for conclusions. Conceptual Framework for Financial Reporting was issued by the International Accounting Standards Board in September 2010. It was revised in March 2018. The 2018 Conceptual Framework is structured into an introductory explanation on the status and purpose of the Conceptual Framework, eight chapters, Chapter Topic Status and purpose of the Conceptual Framework 1. The objectives of general-purpose financial reporting 2. Qualitative characteristics of useful financial information 3. Financial statements and the reporting entity 4. The elements of financial statements 5. Recognition and derecognition 6. Measurement 7. Presentation and disclosure 8. Concepts of capital and capital maintenance

- 2. Chapter 1 - The Objective of General-Purpose Financial Reporting. The objective of general-purpose financial reporting is to provide financial information about the reporting entity that is useful to existing and potential investors, lenders, and other creditors in making decisions relating to providing resources to the entity. This is identified as information about the entity’s economic resources and the claims against the reporting entity as well as information about the effects of transactions and other events that change a reporting entity’s economic resources and claims. This chapter newly stresses that information can also help users to assess management’s stewardship of the entity’s economic resources. Chapter 2 - Qualitative Characteristics of Useful Financial Information. The qualitative characteristics of useful financial information apply to financial information provided in financial statements, as well as to financial information provided in other ways. Cost, which is a pervasive constraint on the reporting entity’s ability to provide useful financial information, applies similarly. However, the considerations in applying the qualitative characteristics and the cost constraint may be different for different types of information. For example, applying them to forward-looking information may be different from applying them to information about existing economic resources and claims and to changes in those resources and claims. The Fundamental Qualitative Characteristics: The fundamental qualitative characteristics are: a) Relevance and b) Faithful Representation Relevance: Relevant financial information can make a difference in the decisions made by users. Information may be capable of making a difference in a decision even if some users choose not to take advantage of it or are already aware of it from other sources. Financial information can make a difference in decisions if it has predictive value, confirmatory value, or both. Financial information has predictive value if it can be used as an input to processes employed by users to predict future outcomes. Financial information need not be a

- 3. prediction or forecast to have predictive value. Financial information with predictive value is employed by users in making their own predictions. Financial information has confirmatory value if it provides feedback about (confirms or changes) previous evaluations. The predictive value and confirmatory value of financial information are interrelated. Information that has predictive value often also has confirmatory value. Faithful representation: Faithful representation means representation of the substance of an economic phenomenon instead of representation of its legal form only. To be a faithful representation, a depiction would have three characteristics. It would be complete, neutral and free from error. A complete depiction includes all information necessary for a user to understand the phenomenon being depicted, including all necessary descriptions and explanations. A neutral depiction is without bias in the choice or presentation of financial information. A neutral depiction is not slanted, weighted, emphasised, de-emphasised or otherwise manipulated to increase the probability that financial information will be received favourably or unfavourably by users. Neutral information does not mean information with no purpose or no influence on behaviour. On the contrary, relevant financial information is, by definition, capable of making a difference in users’ decisions. Faithful representation does not mean correct in all respects. Free from error means there are no errors or omissions in the description of the phenomenon, and the process used to produce the reported information has been selected and applied with no errors in the process. In this context, free from error does not mean perfectly correct in all respects. The Enhancing Qualitative Characteristics: The enhancing qualitative characteristics are: 1. comparability, 2. verifiability, 3. timeliness 4. understandability of useful financial information and notes the cost constraint. Comparability: Comparability is the qualitative characteristic that enables users to find and understand similarities in, and differences among, items. Unlike the other qualitative

- 4. characteristics, comparability does not relate to a single item. A comparison requires at least two items. Consistency: Consistency although related to comparability, is not the same. Consistency refers to the use of the same methods for the same items, either from period to period within a reporting entity or in a single period across entities. Comparability is the goal; consistency helps to achieve that goal. Verifiability: Verifiability helps assure users that information faithfully represents the economic phenomena it purports to represent. Verifiability means that different knowledgeable and independent observers could reach consensus, although not necessarily complete agreement, that a depiction is a faithful representation. Quantified information need not be a single point estimate to be verifiable. A range of possible amounts and the related probabilities can also be verified. Verification can be direct or indirect. Direct verification means verifying an amount or other representation through direct observation, for example, by counting cash. Indirect verification means checking the inputs to a model, formula or other technique and recalculating the outputs using the same method. Timeliness: Timeliness means having information available to decision-makers in time to be capable of influencing their decisions. The older the information is the less useful it is. However, some information may continue to be prompt long after the end of a reporting period because, for example, some users may need to find and assess trends. Understandability: Classifying, characterising and presenting information clearly and concisely makes it understandable. Some phenomena are inherently complex and cannot be made easy to understand. Excluding information about those phenomena from financial reports might make the information in those financial reports easier to understand. However, those reports would be incomplete and therefore possibly misleading. Financial reports are prepared for users who have a reasonable knowledge of business and economic activities and who review and analyse the information diligently. At times, even well-informed and diligent users may need to seek the aid of an adviser to understand information about complex economic phenomena. Materiality: Materiality is an entity-specific aspect of relevance based on the nature or magnitude, or both, of the items to which the information relates in the context of an individual entity’s financial report.

- 5. Neutrality is supported by the exercise of prudence. Prudence is defined as the exercise of caution when making judgements under conditions of uncertainty. The exercise of prudence means that assets and income are not overstated, and liabilities and expenses are not understated. Equally, the exercise of prudence does not allow for the understatement of assets or income or the overstatement of liabilities or expenses. Such misstatements can lead to the overstatement or understatement of income or expenses in future periods. The exercise of prudence does not imply a need for asymmetry, for example, a systematic need for more persuasive evidence to support the recognition of assets or income than the recognition of liabilities or expenses. Such asymmetry is not a qualitative characteristic of useful financial information. Nevertheless, Standards may contain asymmetric requirements if this is a consequence of decisions intended to select the most relevant information that faithfully represents what it purports to represent. Chapter 3 - Financial Statements and The Reporting Entity. The objective of financial statements is to provide information about an entity's assets, liabilities, equity, income and expenses that is useful to financial statements users in assessing the prospects for future net cash inflows to the entity and in assessing management's stewardship of the entity's resources. Also sets out the going concern assumption. It only mentions 3 statements explicitly: a) in the statement of financial position, by recognising assets, liabilities, and equity b) in the statement(s) of financial performance, by recognising income and expenses; and c) in other statements and notes, by presenting and disclosing information The financial statements are prepared for a specified period and provide comparative information and under certain circumstances forward-looking information. New to the framework is the definition of a reporting entity and the boundary of a it. The chapter also states the IASB's conviction that, generally, consolidated financial statements are more likely to provide useful information to users of financial statements than unconsolidated financial statements. Consolidated financial statements provide information about the assets, liabilities, equity, income, and expenses of both the parent and its subsidiaries as a single reporting entity. Consolidated financial statements are not designed to provide separate information about the

- 6. assets, liabilities, equity, income, and expenses of any subsidiary. A subsidiary’s own financial statements are designed to provide that information. Unconsolidated financial statements are designed to provide information about the parent’s assets, liabilities, equity, income, and expenses, and not about those of its subsidiaries. Chapter 4 - The Elements of Financial Statements. The elements of financial statements defined in the Conceptual Framework are • assets, liabilities, and equity (which relate to a reporting entity’s financial position) as well as • income and expenses (which relate to a reporting entity’s financial performance) The definitions are quoted below: Asset: A present economic resource controlled by the entity because of past events. An economic resource is a right that has the potential to produce economic benefits. Liability: A present obligation of the entity to transfer an economic resource because of past events. Equity: The residual interest in the assets of the entity after deducting all its liabilities. Income: Increases in assets or decreases in liabilities that result in increases in equity, other than those relating to contributions from holders of equity claims. Expenses: Decreases in assets or increases in liabilities that result in decreases in equity, other than those relating to distributions to holders of equity claims. New is the introduction of a separate definition of an economic resource to move the references to future flows of economic benefits out of the definitions of an asset and a liability. The expression "economic resource" instead of simply "resource" stresses that the IASB no longer thinks of assets as physical objects but as sets of rights. It means the definitions of assets and liabilities no longer refer to "expected" inflows or outflows. Instead, the definition of an economic resource refers to the potential of an asset/liability to produce/to require a transfer of economic benefits.

- 7. Distinguishing between liabilities and equity is not part of the new framework but has been transferred to the IASB's research project on financial instruments with the characteristics of equity. Chapter 5 - Recognition and Derecognition. The Conceptual Framework states that only items that meet the definition of an asset, a liability or equity are recognised in the statement of financial position and only items that meet the definition of income or expenses are to be recognised in the statement(s) of financial performance. However, their recognition depends on two criteria: their recognition provides users of financial statements with 1. relevant information about the asset or the liability and about any income, expenses, or changes in equity and 2. a faithful representation of the asset or the liability and of any income, expenses, or changes in equity. Relevance: Information about assets, liabilities, equity, income, and expenses is relevant to users of financial statements. However, recognition of a particular asset or liability and any resulting income, expenses or changes in equity may not always provide relevant information. Faithful representation: Recognition of a particular asset or liability is appropriate if it provides not only relevant information, but also a faithful representation of that asset or liability and of any resulting income, expenses, or changes in equity. Whether a faithful representation can be provided may be affected by the level of measurement uncertainty associated with the asset or liability or by other factors. The framework also notes a cost constraint. New to the framework is the discussion of derecognition. The requirements as presented in the framework are driven by two aims: • for an asset, derecognition normally occurs when the entity loses control of all or part of the recognised asset; and • for a liability, derecognition normally occurs when the entity no longer has a present obligation for all or part of the recognised liability The framework also describes alternatives when it is not possible to achieve both aims.

- 8. Chapter 6 - Measurement. Elements recognised in financial statements are quantified in monetary terms. This requires the selection of a measurement basis. A measurement basis is an identified feature—for example, historical cost, fair value, or fulfilment value—of an item being measured. Applying a measurement basis to an asset or liability creates a measure for that asset or liability and for related income and expenses. The framework also sets out factors to consider when • selecting a measurement basis – relevance, faithful representation, enhancing qualitative characteristics and the cost constraint, factors specific to initial measurement, as well as more than one measurement basis, and • points out that consideration of the objective of financial reporting, the qualitative characteristics of useful financial information and the cost constraint are likely to result in the selection of different measurement bases for different assets, liabilities and items of income and expense. The framework does not provide detailed guidance on when a measurement basis would be suitable because the suitability of measurement bases will vary depending on facts and circumstances. On equity, the framework offers some limited discussion, although total equity is not measured directly. Still, the framework maintains, it may be appropriate to measure directly individual classes of equity or components of equity to provide useful information. Chapter 7 - Presentation and Disclosure. In this chapter, the framework discusses concepts that determine what information is included in the financial statements and how that information should be presented and disclosed. The statement of statement of comprehensive income is newly described as "Statement of Financial Performance". However, the framework does not specify whether this statement should consist of a single statement or two statements, it only requires that a total or subtotal for profit or loss must be provided.

- 9. It also notes that the statement of profit or loss is the primary source of information about an entity’s financial performance for the reporting period and that only in "exceptional circumstances" the Board may decide that income or expenses are to be included in other comprehensive income. Notably, the framework does not define profit or loss, thus the question of what goes into profit or loss or into other comprehensive income is still unanswered. Offsetting Offsetting occurs when an entity recognises and measures both an asset and liability as separate units of account, but groups them into a single net amount in the statement of financial position. Offsetting classifies dissimilar items together and therefore is not appropriate. Offsetting assets and liabilities differs from treating a set of rights and obligations as a single unit of account Chapter 8 - Concepts of capital and capital maintenance. The content in this chapter was taken over from the existing Conceptual Framework and discusses concepts of capital (financial and physical), concepts of capital maintenance (again financial and physical) and the determination of profit as well as capital maintenance adjustments. The concepts of capital in give rise to the following concepts of capital maintenance: a) Financial capital maintenance: Under this concept a profit is earned only if the financial (or money) amount of the net assets at the end of the period exceeds the financial (or money) amount of net assets at the beginning of the period, after excluding any distributions to, and contributions from, owners during the period. Financial capital maintenance can be measured in either nominal monetary units or units of constant purchasing power. b) Physical capital maintenance: Under this concept a profit is earned only if the physical productive capacity (or operating capability) of the entity (or the resources or funds needed to achieve that capacity) at the end of the period exceeds the physical productive capacity at the beginning of the period, after excluding any distributions to, and contributions from, owners during the period.

- 10. The principal difference between the two concepts of capital maintenance is the treatment of the effects of changes in the prices of assets and liabilities of the entity. In general terms, an entity has maintained its capital if it has as much capital at the end of the period as it had at the beginning of the period. Any amount over and above that required to maintain the capital at the beginning of the period is profit. The IASB decided that updating the discussion of capital and capital maintenance could have delayed the completion of the framework significantly. The Board might consider revising the description and discussion of capital maintenance in the future if it considers such a revision necessary.