The document provides an overview of commodities trading, including:

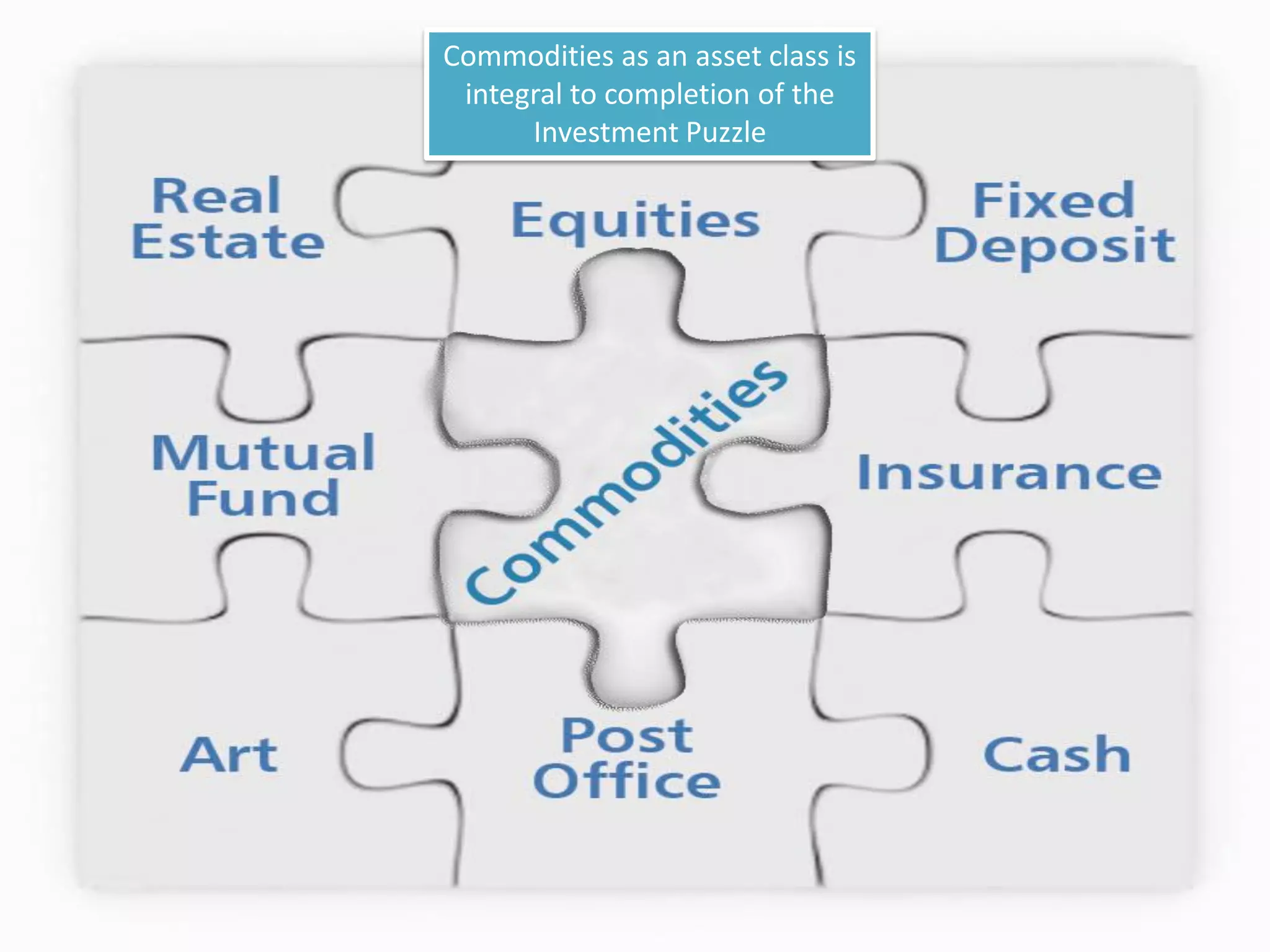

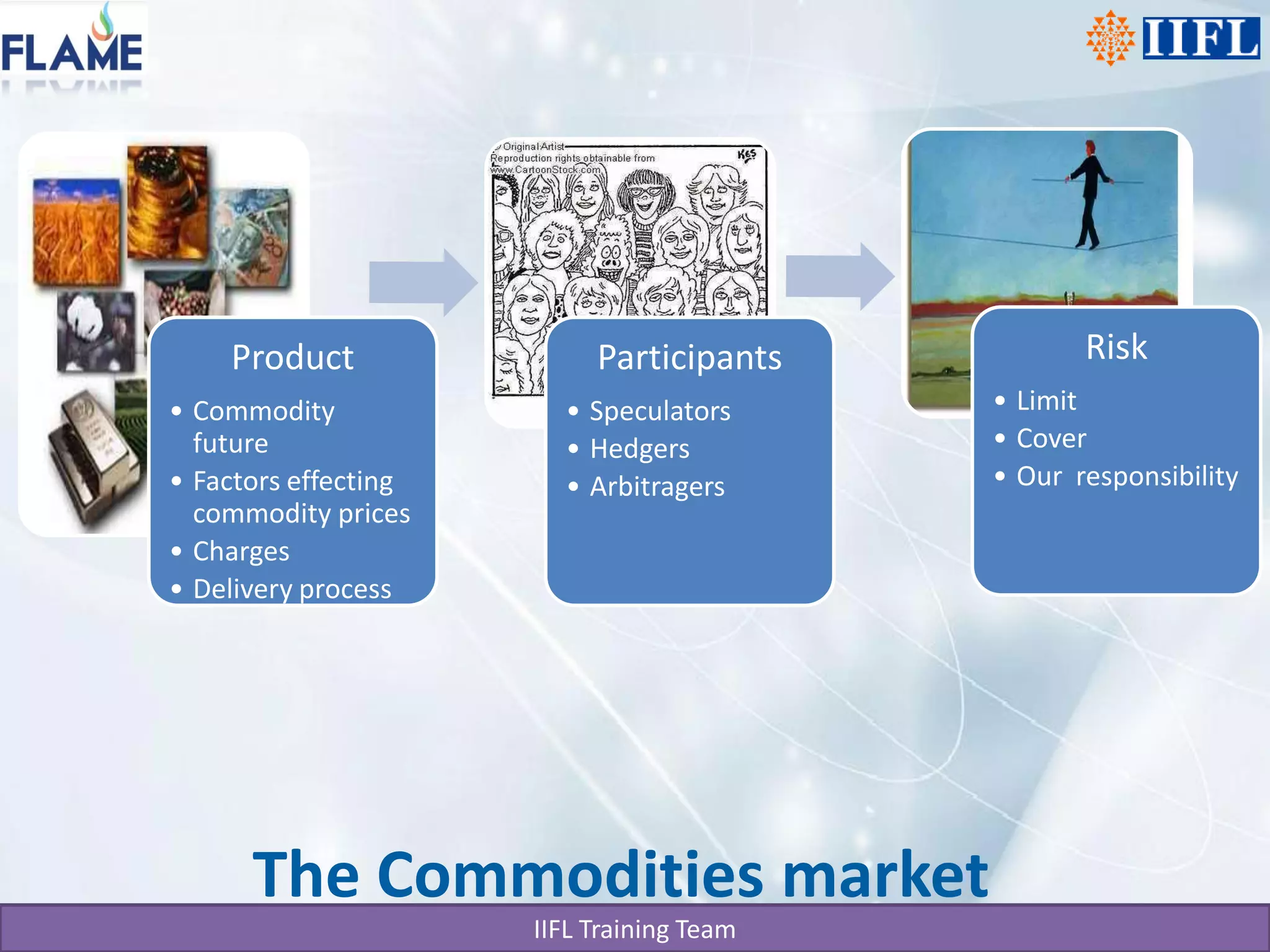

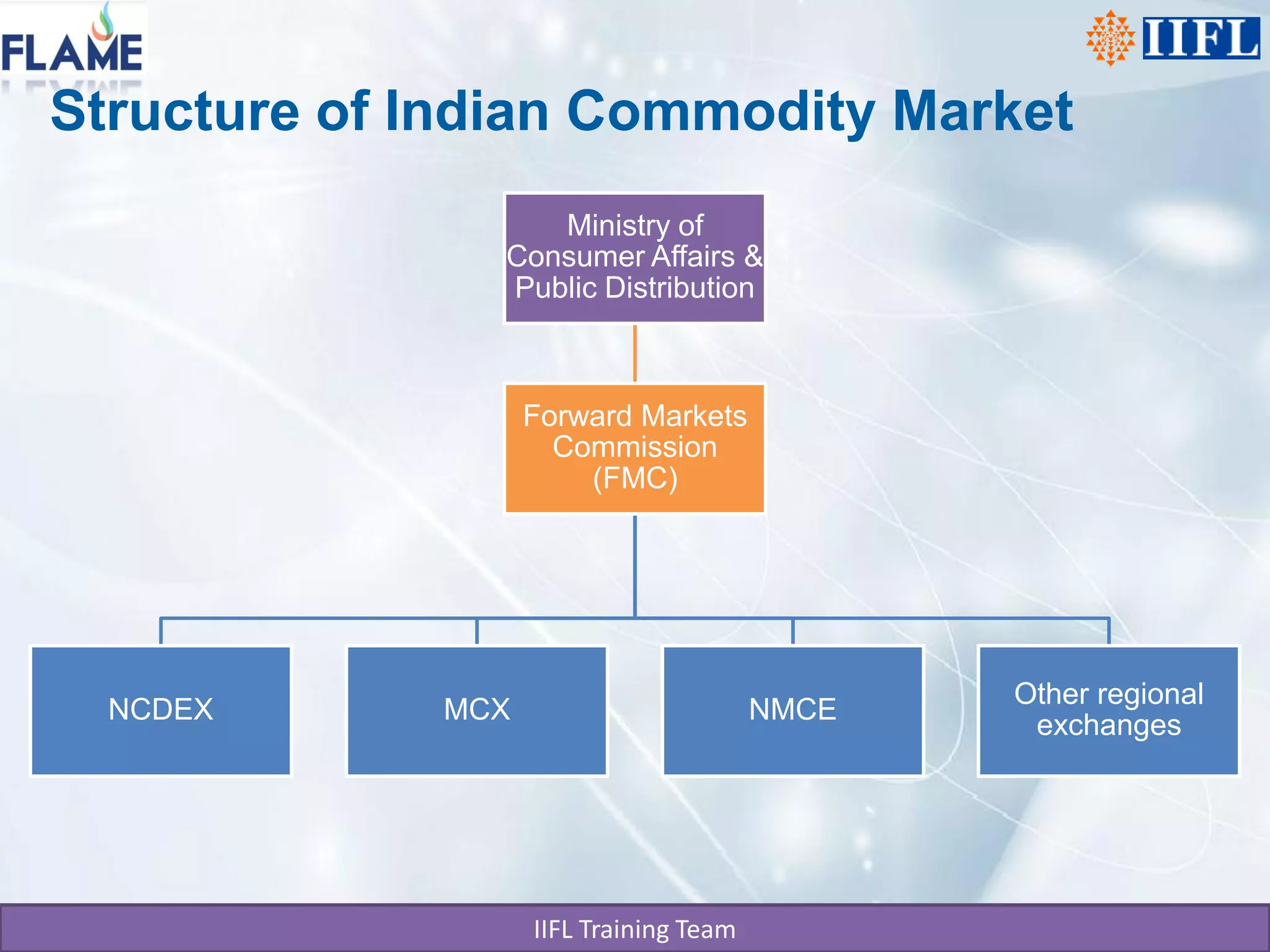

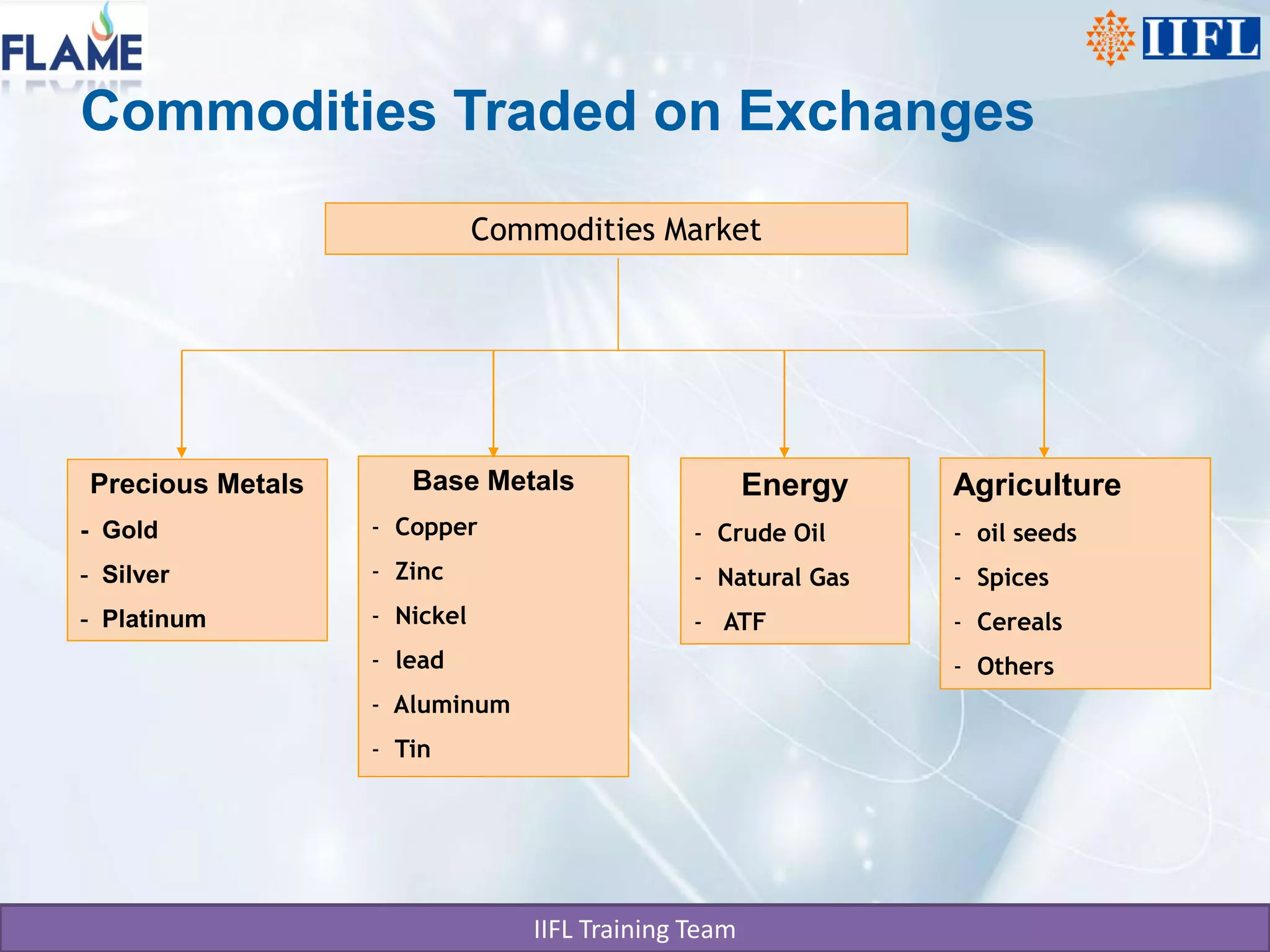

- Commodities include agricultural and non-agricultural goods that are traded on exchanges. Key exchanges discussed are MCX and NCDEX in India.

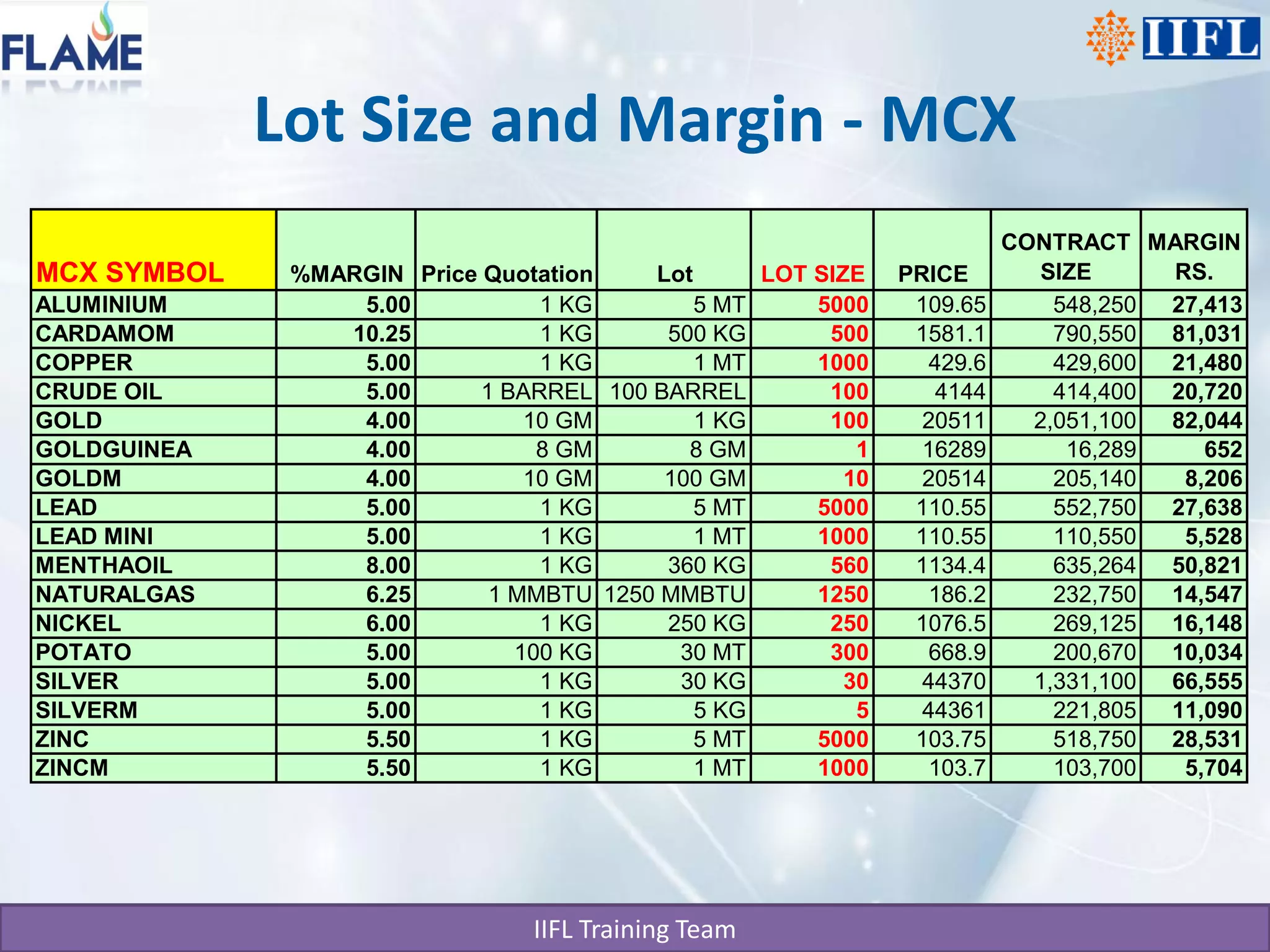

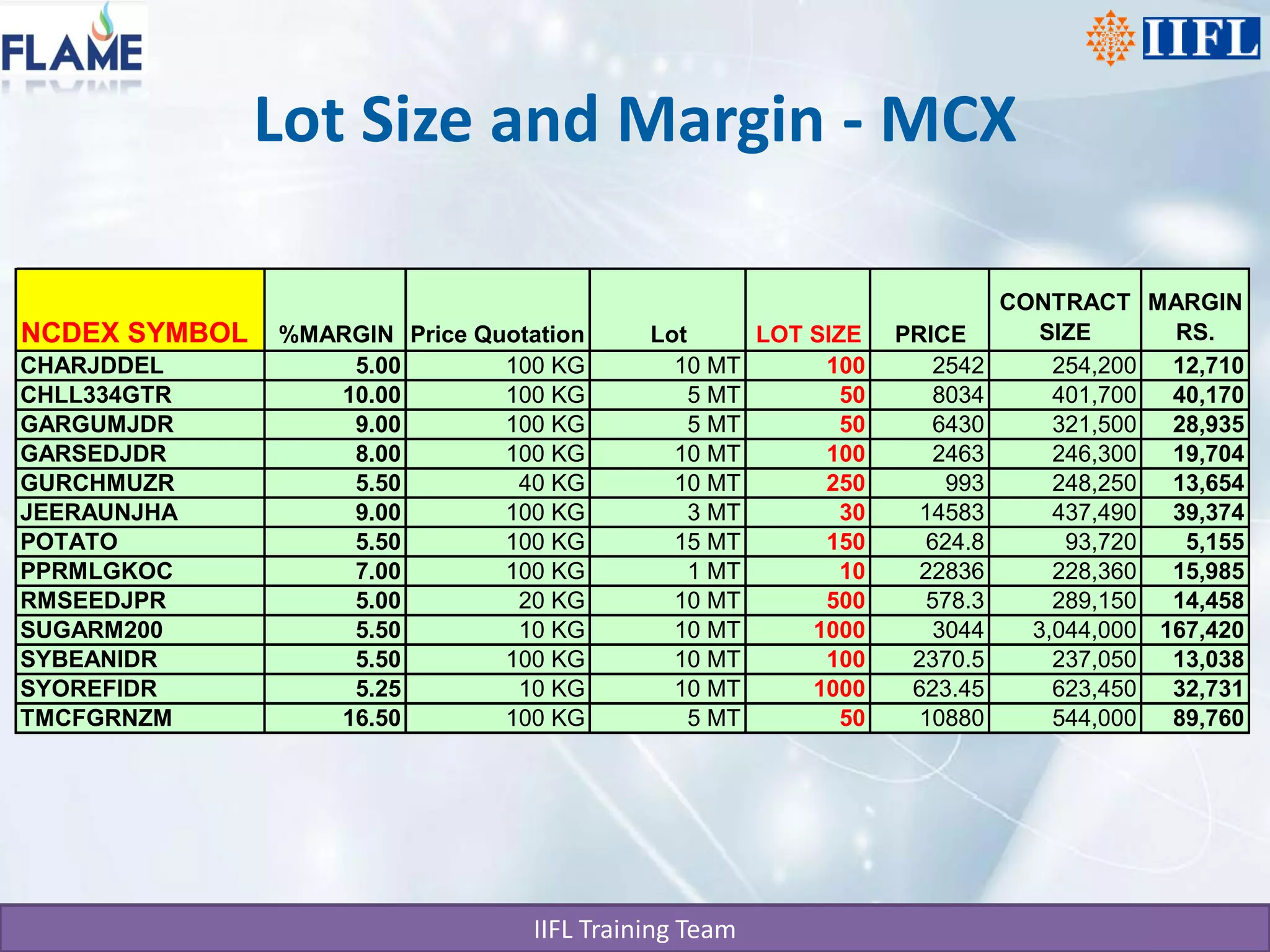

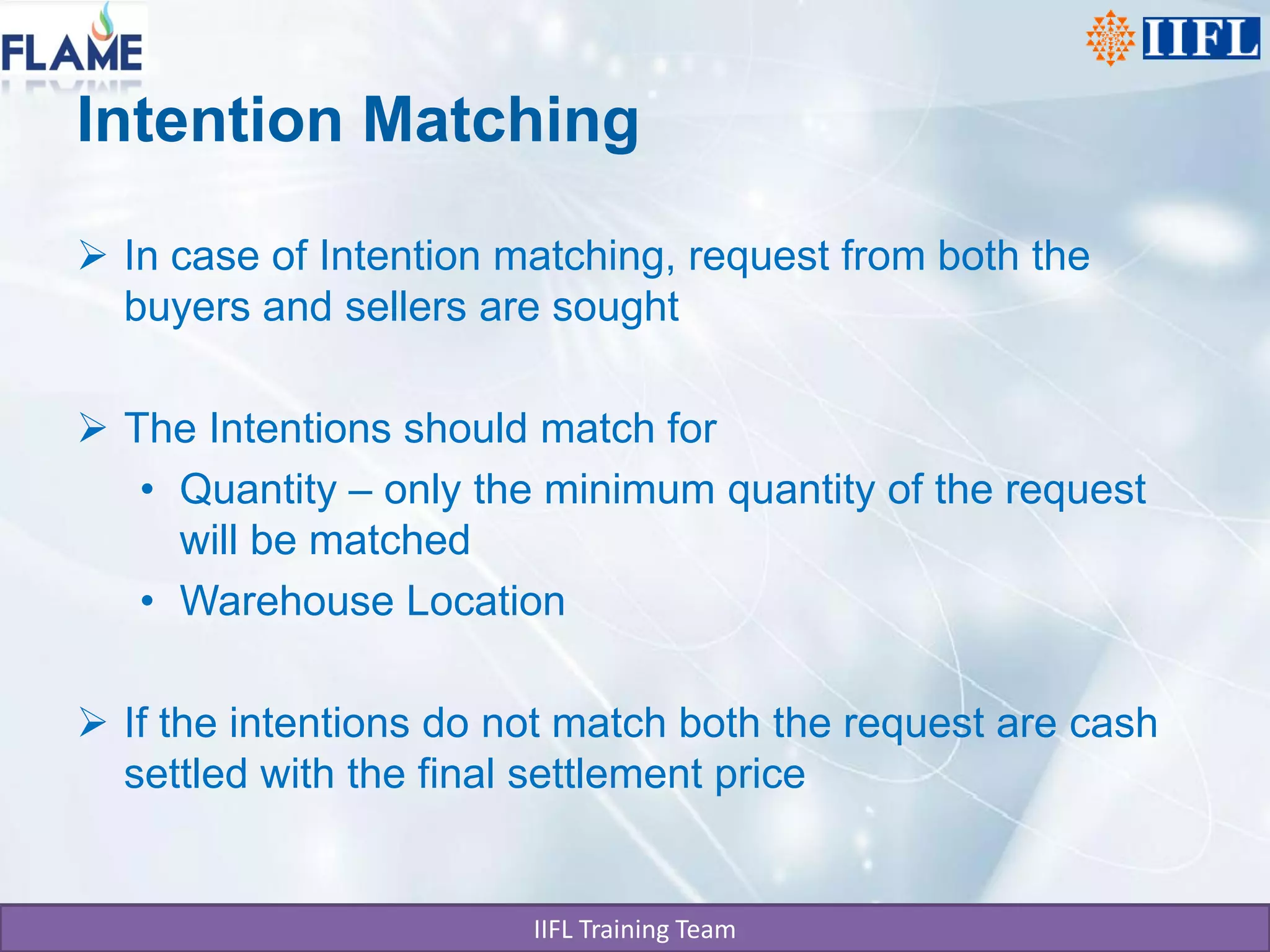

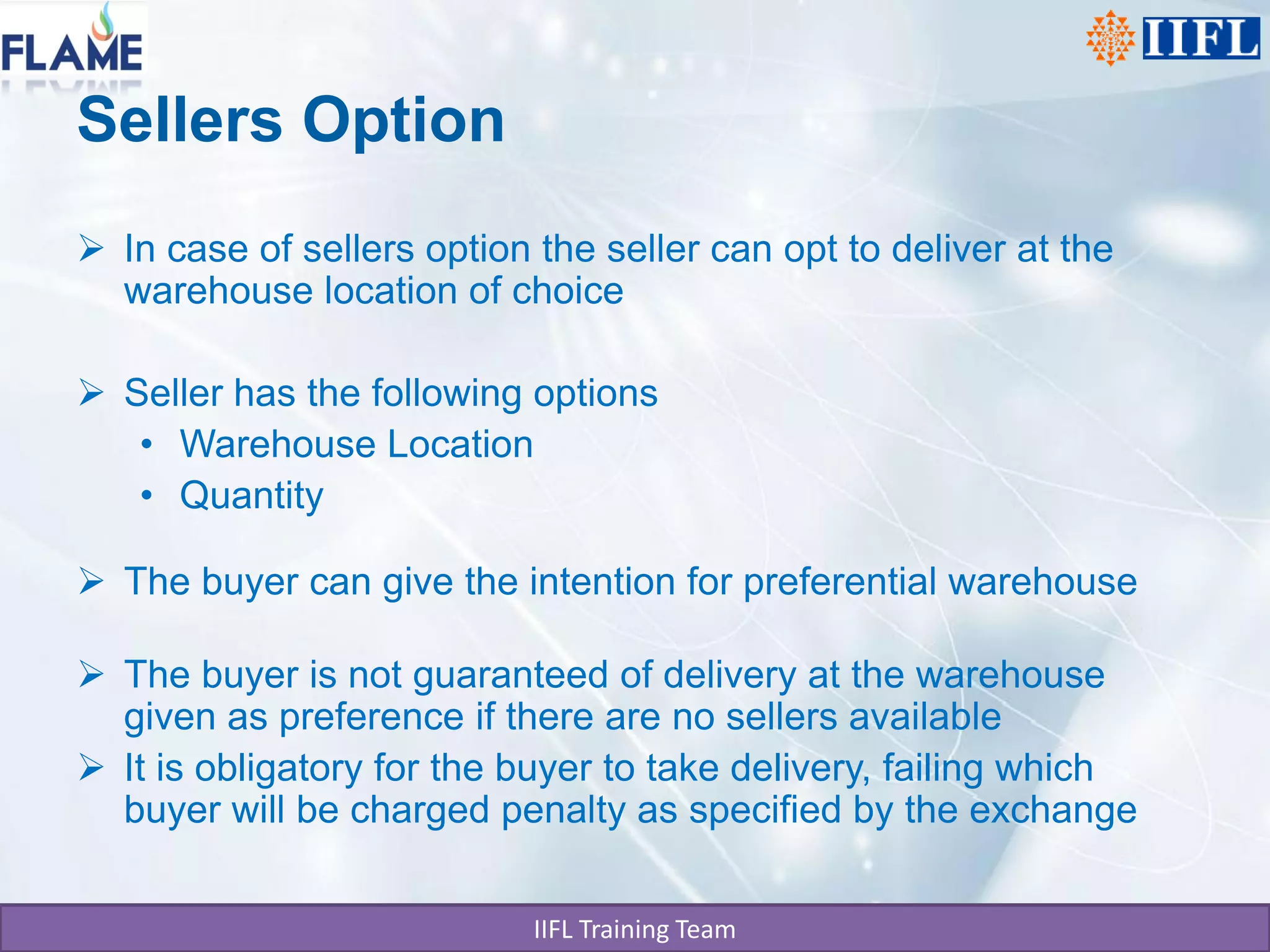

- Derivatives like futures contracts allow traders to take positions in commodities and profit from price movements. Margin requirements and delivery processes are outlined.

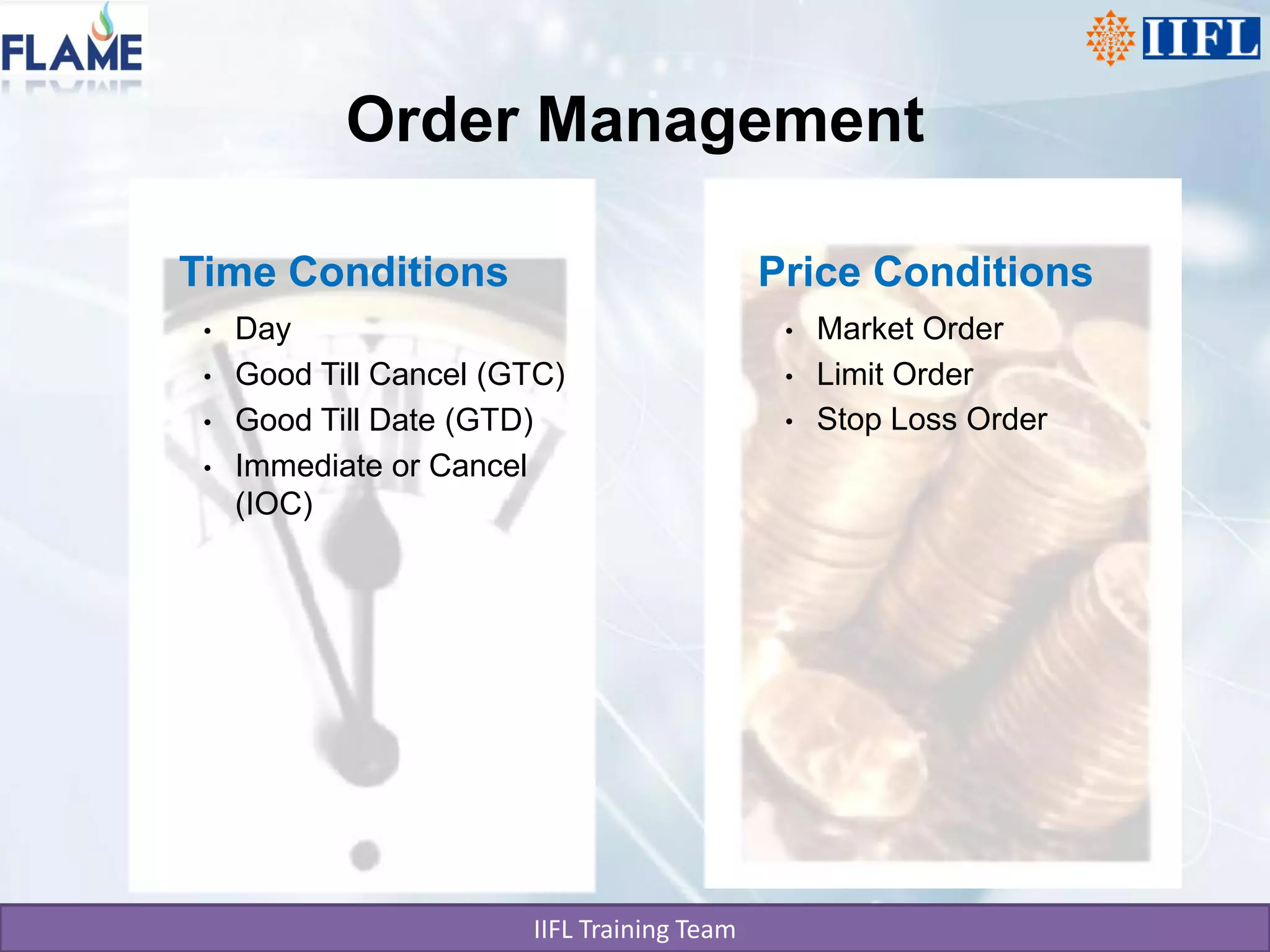

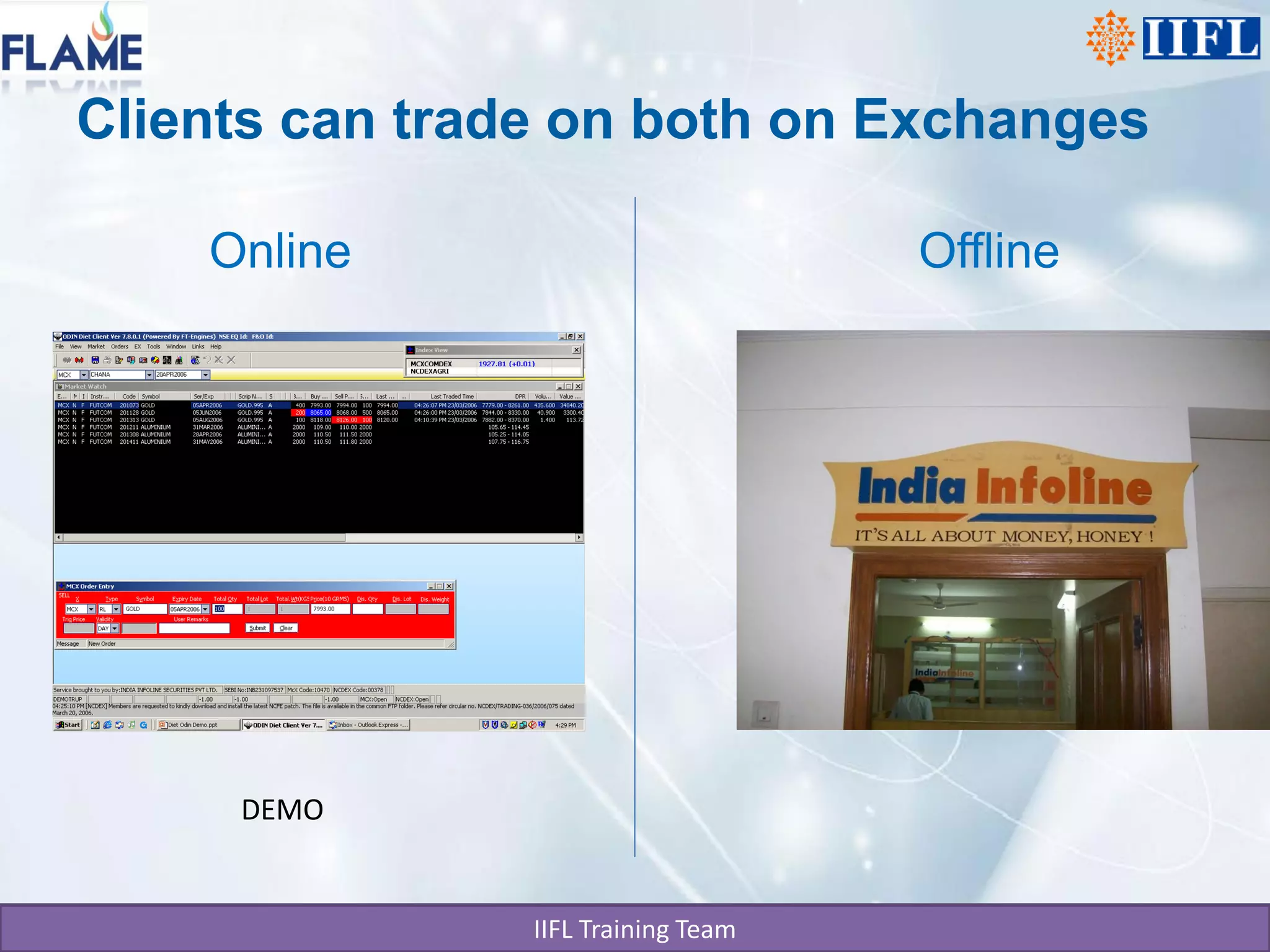

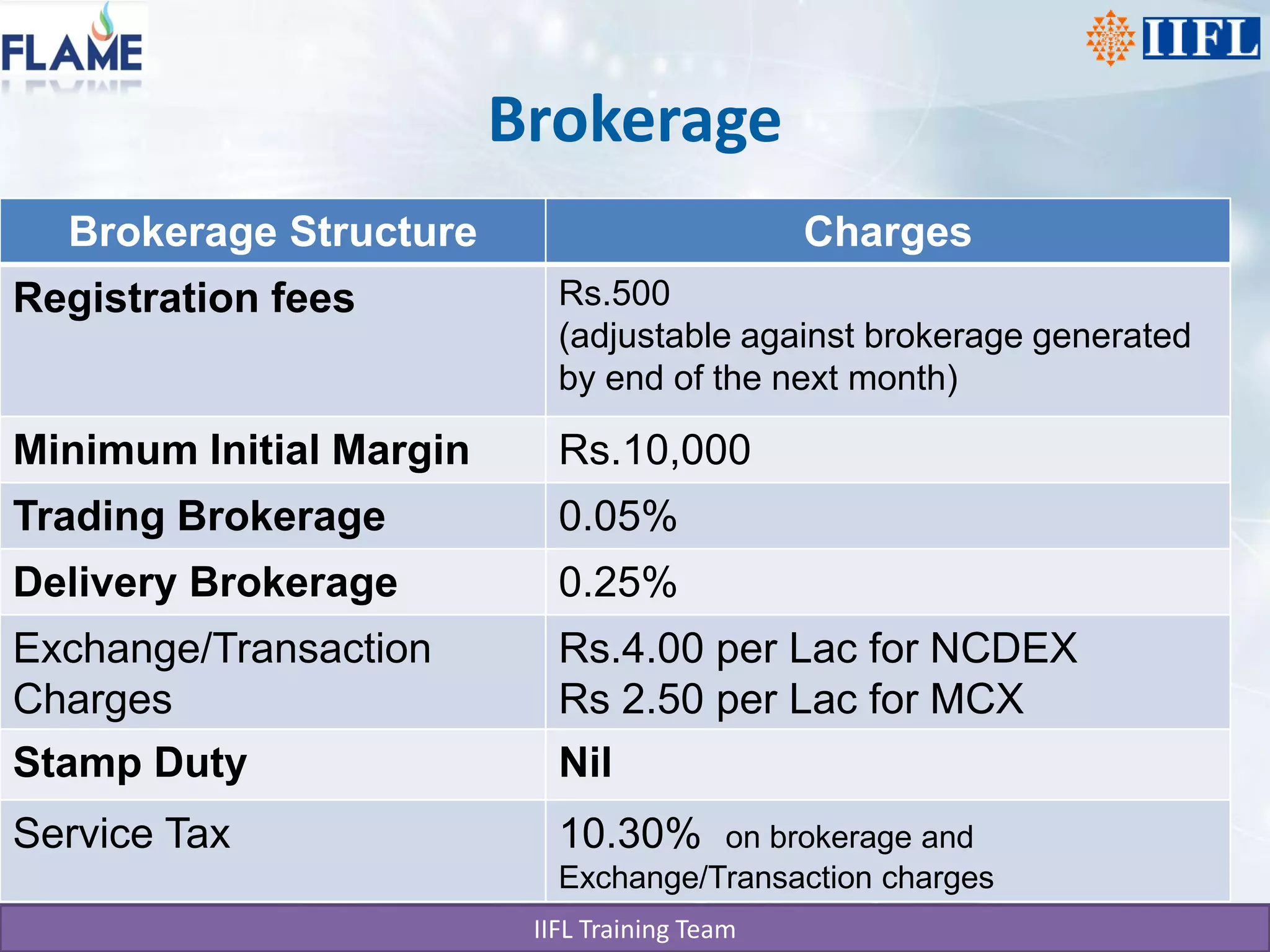

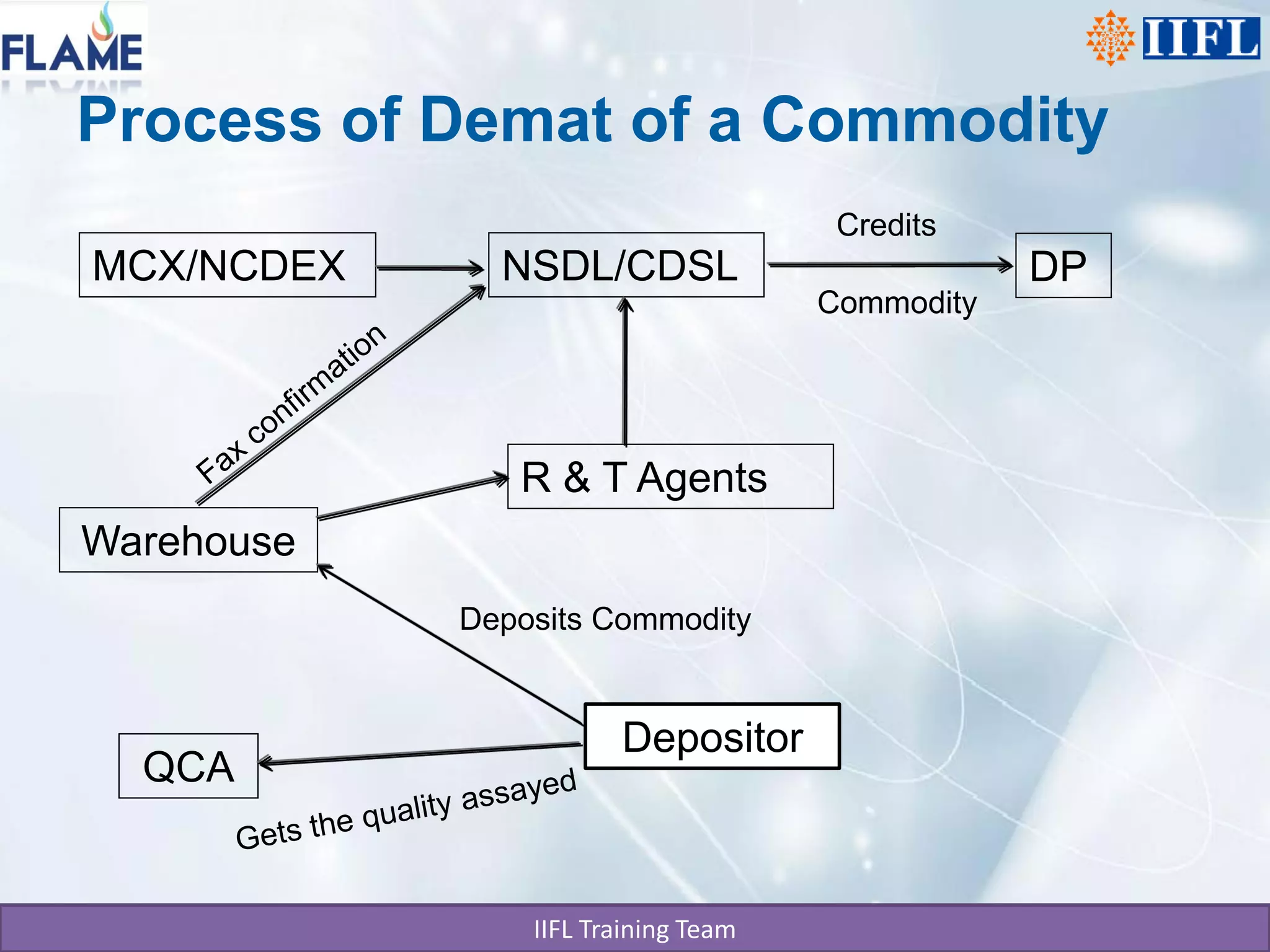

- Various order types, brokerage charges, and trading timelines are reviewed for the Indian commodity exchanges. Physical delivery and demat processes are also summarized.

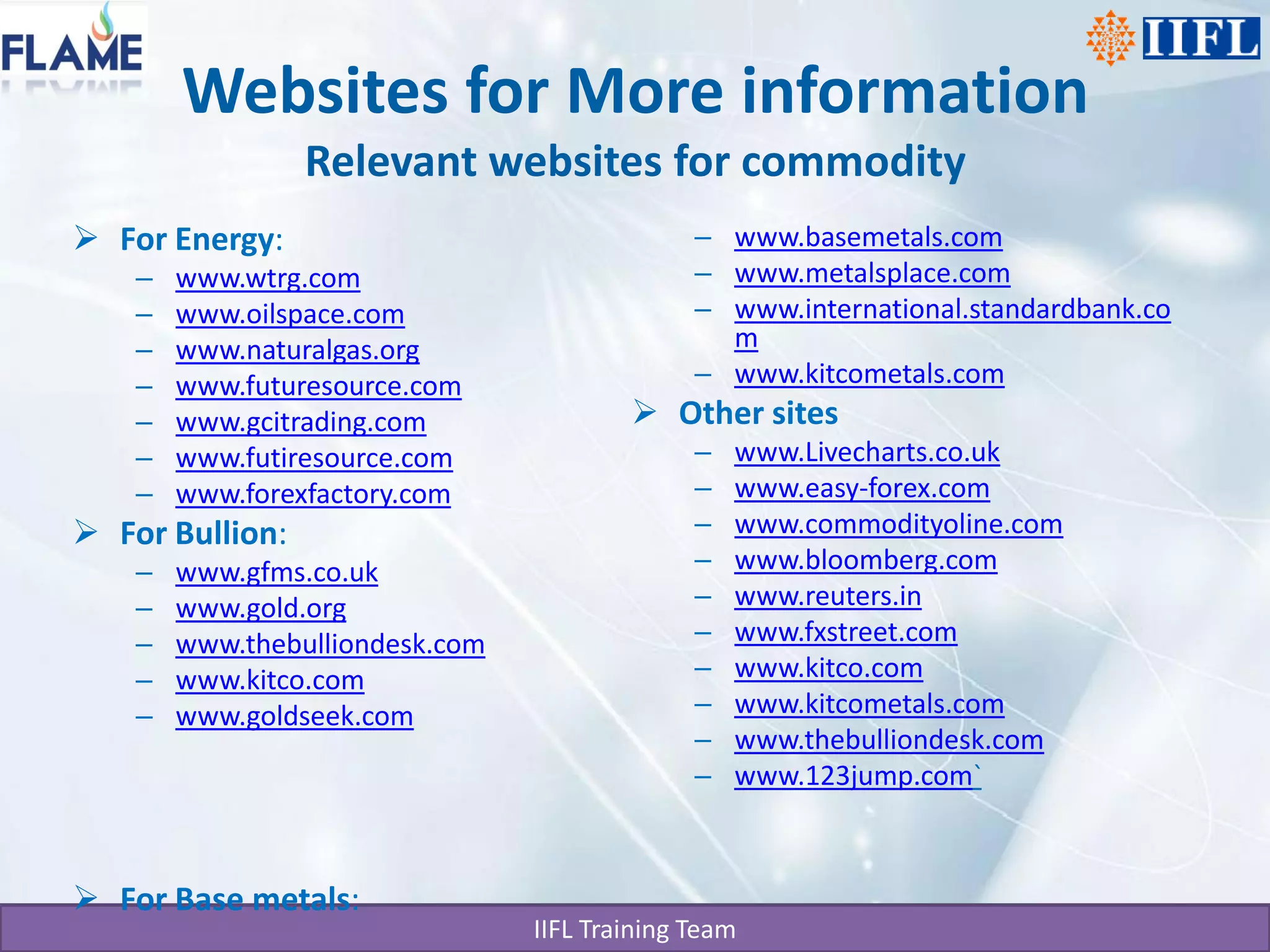

- Additional resources like exchange websites are recommended for more information on participating, margins, contract specs, and trading commodities.