BC Mortgage Rate Forecast March 2011

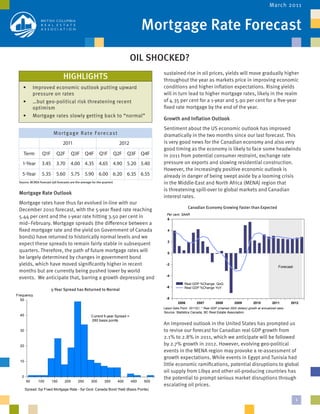

- 1. March 2011 Mortgage Rate Forecast OIL SHOCKED? sustained rise in oil prices, yields will move gradually higher HIGHLIGHTS throughout the year as markets price in improving economic • Improved economic outlook putting upward conditions and higher inflation expectations. Rising yields pressure on rates will in turn lead to higher mortgage rates, likely in the realm • …but geo-political risk threatening recent of 4.35 per cent for a 1-year and 5.90 per cent for a five-year optimism fixed rate mortgage by the end of the year. • Mortgage rates slowly getting back to “normal” Growth and Inflation Outlook Sentiment about the US economic outlook has improved Mortgage Rate Forecast dramatically in the two months since our last forecast. This 2011 2012 is very good news for the Canadian economy and also very good timing as the economy is likely to face some headwinds Term Q1F Q2F Q3F Q4F Q1F Q2F Q3F Q4F in 2011 from potential consumer restraint, exchange rate 1-Year 3.45 3.70 4.00 4.35 4.65 4.90 5.20 5.40 pressure on exports and slowing residential construction. However, the increasingly positive economic outlook is 5-Year 5.35 5.60 5.75 5.90 6.00 6.20 6.35 6.55 already in danger of being swept aside by a looming crisis Source: BCREA Forecast (all forecasts are the average for the quarter) in the Middle-East and North Africa (MENA) region that is threatening spill-over to global markets and Canadian Mortgage Rate Outlook interest rates. Mortgage rates have thus far evolved in-line with our Canadian Economy Growing Faster than Expected December 2010 forecast, with the 5-year fixed rate reaching Per cent, SAAR 5.44 per cent and the 1-year rate hitting 3.50 per cent in 6 mid–February. Mortgage spreads (the difference between a fixed mortgage rate and the yield on Government of Canada 4 bonds) have returned to historically normal levels and we 2 expect these spreads to remain fairly stable in subsequent quarters. Therefore, the path of future mortgage rates will 0 be largely determined by changes in government bond yields, which have moved significantly higher in recent -2 Forecast months but are currently being pushed lower by world -4 events. We anticipate that, barring a growth depressing and Real GDP %Change. QoQ -6 Real GDP %Change YoY 5-Year Spread has Returned to Normal Frequency 50 -8 2006 2007 2008 2009 2010 2011 2012 Latest Data Point: 2011Q1, * Real GDP (chained 2002 dollars) growth at annualized rates Source: Statistics Canada, BC Real Estate Association 40 Current 5-year Spread = 280 basis points An improved outlook in the United States has prompted us 30 to revise our forecast for Canadian real GDP growth from 2.1% to 2.8% in 2011, which we anticipate will be followed 20 by 2.7% growth in 2012. However, evolving geo-political events in the MENA region may provoke a re-assessment of growth expectations. While events in Egypt and Tunisia had 10 little economic ramifications, potential disruptions to global oil supply from Libya and other oil-producing countries has 0 the potential to prompt serious market disruptions through 50 100 150 200 250 300 350 400 450 500 escalating oil prices. Spread: 5yr Fixed Mortgage Rate - 5yr Govt. Canada Bond Yield (Basis Points) 1

- 2. BCREA Mortgage Rate Forecast March 2011 The dynamics of how oil impacts the Canadian economy are Core Inflation Subdued but Expectations Rising complex. As an oil exporting country, higher energy prices can have a positive impact on growth. However, the negative impact of high oil prices is two-pronged. First, high oil prices (beyond $120 per barrel) have been shown to significantly reduce US economic growth. Moreover, the Canadian dollar has for years been tied to the price of oil. As oil rises, so too does the loonie, which may present a serious challenge for Canadian trade. Therefore, the negative impact of an oil shock likely outweighs any positive effects for the Canadian economy. Loonie Soars Along with Oil Prices Note: Expected inflation measured from the difference between Real-Return and Long-Term Government Bonds Source: Bank of Canada Interest Rate Outlook As expected, the Bank of Canada held its overnight rate at 1 per cent at its March 1st meeting. In absence of nascent geo-political risk and the soaring loonie, the stronger than expected pace of economic growth may have alone been enough to push the Bank to raise rates at its next meeting in April. However, the risk posed to the global economy by a still evolving situation in the MENA region along with the anti-inflationary (and potentially growth-subduing) impact of the loonie’s rise will likely see the Bank erring on the side of caution and therefore holding rates steady until the summer. Once the Bank resumes rate increases, we expect Regarding inflation, our view remains that inflation is the overnight rate to rise from one per cent to between 1.75 not likely to be a problem in the medium term. However, and 2 per cent by end of 2011. inflation expectations have ticked higher in recent months, A much improved economic outlook has prompted a a result of both positive incoming economic data and some steepening of both the Canadian and US yield curves, with pricing pressure from soaring food and energy prices. So large movements occurring in the 5-10 year maturities. far, the sharply higher food and energy prices that have However, some of the increase has been offset by growing been pushing headline CPI inflation higher have not found risk aversion as investors flee back into safe assets to wait their way through to core-measures of inflation watched by out events in the MENA region. The unpredictability (in both Central Banks. Moreover, as an oil producing country, much the severity and duration) of this still developing situation of the inflationary impact of an increase in energy prices should translate to volatility in bond yields going forward, tends to be offset by an appreciation in the loonie – which but we maintain that Canadian interest rates will ultimately has hit a three-year high of $1.03 US as oil prices pushed end the year higher. over $100 US per barrel. Send questions and comments about Mortgage Rate Forecast to: Cameron Muir, Chief Economist, cmuir@bcrea.bc.ca; Brendon Ogmundson, Economist, bogmundson@bcrea.bc.ca. Additional economics information is available on BCREA’s website at: www.bcrea.bc.ca. To sign up for BCREA news releases by email visit: www.bcrea.bc.ca/publications/subscribe.htm. Mortgage Rate Forecast is published quarterly by the British Columbia Real Estate Association. Real estate boards, real estate associations and REALTORS® may reprint this content, provided that credit is given to BCREA by including the following statement: “Copyright British Columbia Real Estate Association. Reprinted with permission.” BCREA makes no guarantees as to the accuracy or completeness of this information. 2 1420 - 701 Georgia Street West, PO Box 10123, Pacific Centre, Vancouver, BC V7Y 1C6 | Phone: 604.683.7702 | Fax: 604.683.8601 | Email: bcrea@bcrea.bc.ca